Autoregressions¶

This notebook introduces autoregression modeling using the AutoReg model. It also covers aspects of ar_select_order assists in selecting models that minimize an information criteria such as the AIC. An autoregressive model has dynamics given by

AutoReg also permits models with:

Deterministic terms (

trend)n: No deterministic termc: Constant (default)ct: Constant and time trendt: Time trend onlySeasonal dummies (

seasonal)Trueincludes s−1 dummies where s is the period of the time series (e.g., 12 for monthly)Custom deterministic terms (

deterministic)Accepts a

DeterministicProcessExogenous variables (

exog)A

DataFrameorarrayof exogenous variables to include in the modelOmission of selected lags (

lags)If

lagsis an iterable of integers, then only these are included in the model.

The complete specification is

where:

di is a seasonal dummy that is 1 if mod(t,period)=i. Period 0 is excluded if the model contains a constant (

cis intrend).t is a time trend (1,2,…) that starts with 1 in the first observation.

xt,j are exogenous regressors. Note these are time-aligned to the left-hand-side variable when defining a model.

ϵt is assumed to be a white noise process.

This first cell imports standard packages and sets plats to appear inline.

[1]:

%matplotlib inline

import matplotlib.pyplot as plt

import pandas as pd

import pandas_datareader as pdr

import seaborn as sns

from statsmodels.tsa.ar_model import AutoReg, ar_select_order

from statsmodels.tsa.api import acf, pacf, graphics

This cell sets the plotting style, registers pandas date converters for matplotlib, and sets the default figure size.

[2]:

sns.set_style('darkgrid')

pd.plotting.register_matplotlib_converters()

# Default figure size

sns.mpl.rc('figure',figsize=(16, 6))

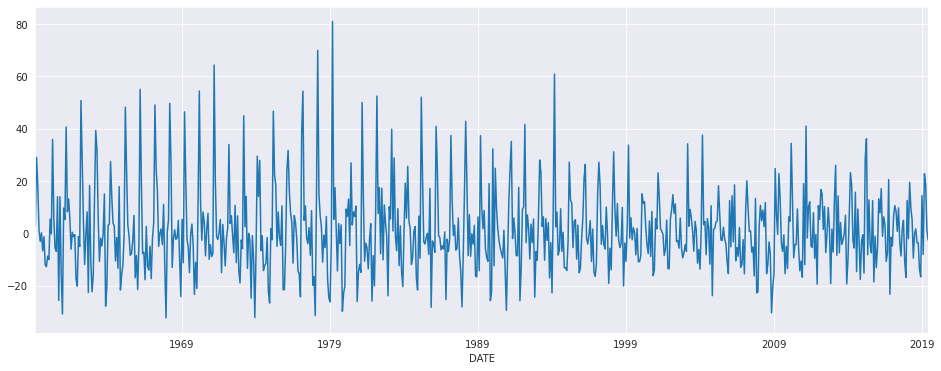

The first set of examples uses the month-over-month growth rate in U.S. Housing starts that has not been seasonally adjusted. The seasonality is evident by the regular pattern of peaks and troughs. We set the frequency for the time series to “MS” (month-start) to avoid warnings when using AutoReg.

[3]:

data = pdr.get_data_fred('HOUSTNSA', '1959-01-01', '2019-06-01')

housing = data.HOUSTNSA.pct_change().dropna()

# Scale by 100 to get percentages

housing = 100 * housing.asfreq('MS')

fig, ax = plt.subplots()

ax = housing.plot(ax=ax)

We can start with an AR(3). While this is not a good model for this data, it demonstrates the basic use of the API.

[4]:

mod = AutoReg(housing, 3, old_names=False)

res = mod.fit()

print(res.summary())

AutoReg Model Results

==============================================================================

Dep. Variable: HOUSTNSA No. Observations: 725

Model: AutoReg(3) Log Likelihood -2993.442

Method: Conditional MLE S.D. of innovations 15.289

Date: Tue, 02 Feb 2021 AIC 5.468

Time: 06:54:39 BIC 5.500

Sample: 05-01-1959 HQIC 5.480

- 06-01-2019

===============================================================================

coef std err z P>|z| [0.025 0.975]

-------------------------------------------------------------------------------

const 1.1228 0.573 1.961 0.050 0.000 2.245

HOUSTNSA.L1 0.1910 0.036 5.235 0.000 0.120 0.263

HOUSTNSA.L2 0.0058 0.037 0.155 0.877 -0.067 0.079

HOUSTNSA.L3 -0.1939 0.036 -5.319 0.000 -0.265 -0.122

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 0.9680 -1.3298j 1.6448 -0.1499

AR.2 0.9680 +1.3298j 1.6448 0.1499

AR.3 -1.9064 -0.0000j 1.9064 -0.5000

-----------------------------------------------------------------------------

AutoReg supports the same covariance estimators as OLS. Below, we use cov_type="HC0", which is White’s covariance estimator. While the parameter estimates are the same, all of the quantities that depend on the standard error change.

[5]:

res = mod.fit(cov_type="HC0")

print(res.summary())

AutoReg Model Results

==============================================================================

Dep. Variable: HOUSTNSA No. Observations: 725

Model: AutoReg(3) Log Likelihood -2993.442

Method: Conditional MLE S.D. of innovations 15.289

Date: Tue, 02 Feb 2021 AIC 5.468

Time: 06:54:39 BIC 5.500

Sample: 05-01-1959 HQIC 5.480

- 06-01-2019

===============================================================================

coef std err z P>|z| [0.025 0.975]

-------------------------------------------------------------------------------

const 1.1228 0.601 1.869 0.062 -0.055 2.300

HOUSTNSA.L1 0.1910 0.035 5.499 0.000 0.123 0.259

HOUSTNSA.L2 0.0058 0.039 0.150 0.881 -0.070 0.081

HOUSTNSA.L3 -0.1939 0.036 -5.448 0.000 -0.264 -0.124

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 0.9680 -1.3298j 1.6448 -0.1499

AR.2 0.9680 +1.3298j 1.6448 0.1499

AR.3 -1.9064 -0.0000j 1.9064 -0.5000

-----------------------------------------------------------------------------

[6]:

sel = ar_select_order(housing, 13, old_names=False)

sel.ar_lags

res = sel.model.fit()

print(res.summary())

AutoReg Model Results

==============================================================================

Dep. Variable: HOUSTNSA No. Observations: 725

Model: AutoReg(13) Log Likelihood -2676.157

Method: Conditional MLE S.D. of innovations 10.378

Date: Tue, 02 Feb 2021 AIC 4.722

Time: 06:54:39 BIC 4.818

Sample: 03-01-1960 HQIC 4.759

- 06-01-2019

================================================================================

coef std err z P>|z| [0.025 0.975]

--------------------------------------------------------------------------------

const 1.3615 0.458 2.970 0.003 0.463 2.260

HOUSTNSA.L1 -0.2900 0.036 -8.161 0.000 -0.360 -0.220

HOUSTNSA.L2 -0.0828 0.031 -2.652 0.008 -0.144 -0.022

HOUSTNSA.L3 -0.0654 0.031 -2.106 0.035 -0.126 -0.005

HOUSTNSA.L4 -0.1596 0.031 -5.166 0.000 -0.220 -0.099

HOUSTNSA.L5 -0.0434 0.031 -1.387 0.165 -0.105 0.018

HOUSTNSA.L6 -0.0884 0.031 -2.867 0.004 -0.149 -0.028

HOUSTNSA.L7 -0.0556 0.031 -1.797 0.072 -0.116 0.005

HOUSTNSA.L8 -0.1482 0.031 -4.803 0.000 -0.209 -0.088

HOUSTNSA.L9 -0.0926 0.031 -2.960 0.003 -0.154 -0.031

HOUSTNSA.L10 -0.1133 0.031 -3.665 0.000 -0.174 -0.053

HOUSTNSA.L11 0.1151 0.031 3.699 0.000 0.054 0.176

HOUSTNSA.L12 0.5352 0.031 17.133 0.000 0.474 0.596

HOUSTNSA.L13 0.3178 0.036 8.937 0.000 0.248 0.388

Roots

==============================================================================

Real Imaginary Modulus Frequency

------------------------------------------------------------------------------

AR.1 1.0913 -0.0000j 1.0913 -0.0000

AR.2 0.8743 -0.5018j 1.0080 -0.0829

AR.3 0.8743 +0.5018j 1.0080 0.0829

AR.4 0.5041 -0.8765j 1.0111 -0.1669

AR.5 0.5041 +0.8765j 1.0111 0.1669

AR.6 0.0056 -1.0530j 1.0530 -0.2491

AR.7 0.0056 +1.0530j 1.0530 0.2491

AR.8 -0.5263 -0.9335j 1.0716 -0.3317

AR.9 -0.5263 +0.9335j 1.0716 0.3317

AR.10 -0.9525 -0.5880j 1.1194 -0.4120

AR.11 -0.9525 +0.5880j 1.1194 0.4120

AR.12 -1.2928 -0.2608j 1.3189 -0.4683

AR.13 -1.2928 +0.2608j 1.3189 0.4683

------------------------------------------------------------------------------

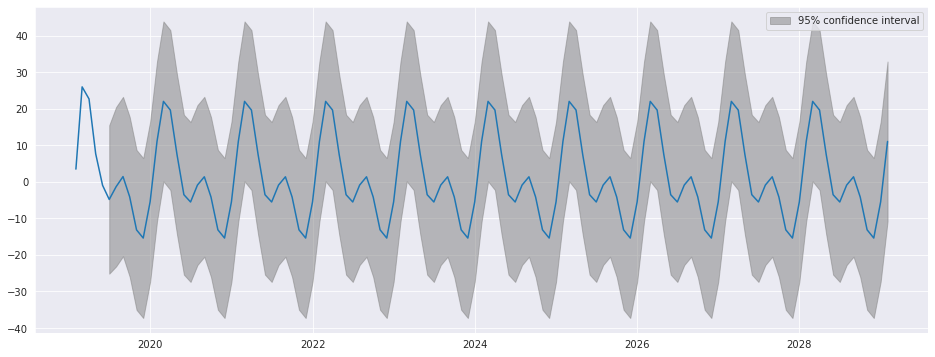

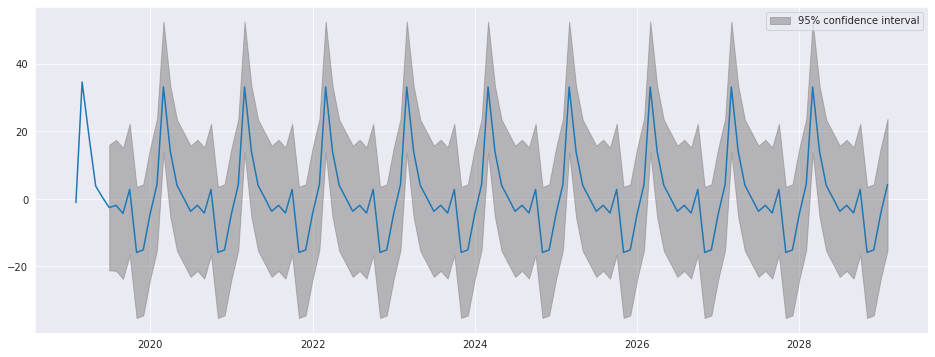

plot_predict visualizes forecasts. Here we produce a large number of forecasts which show the string seasonality captured by the model.

[7]:

fig = res.plot_predict(720, 840)

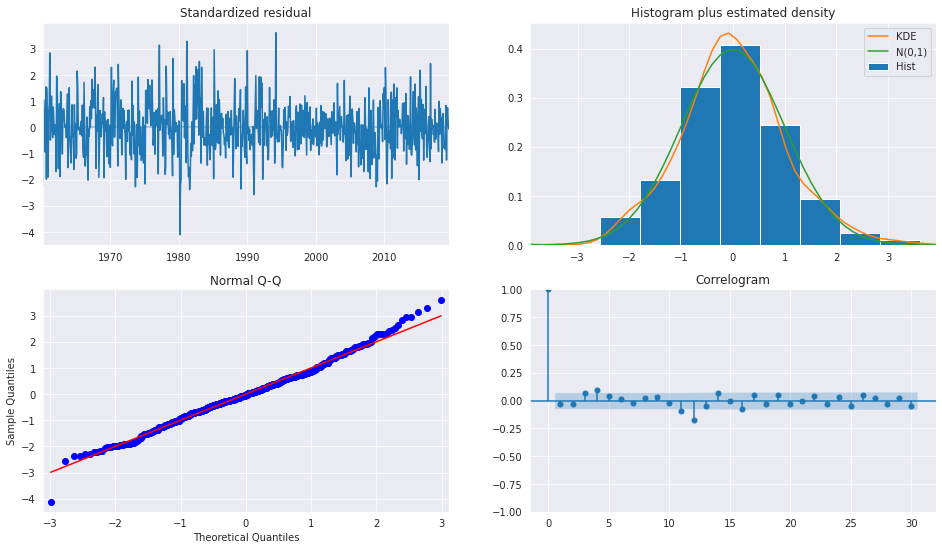

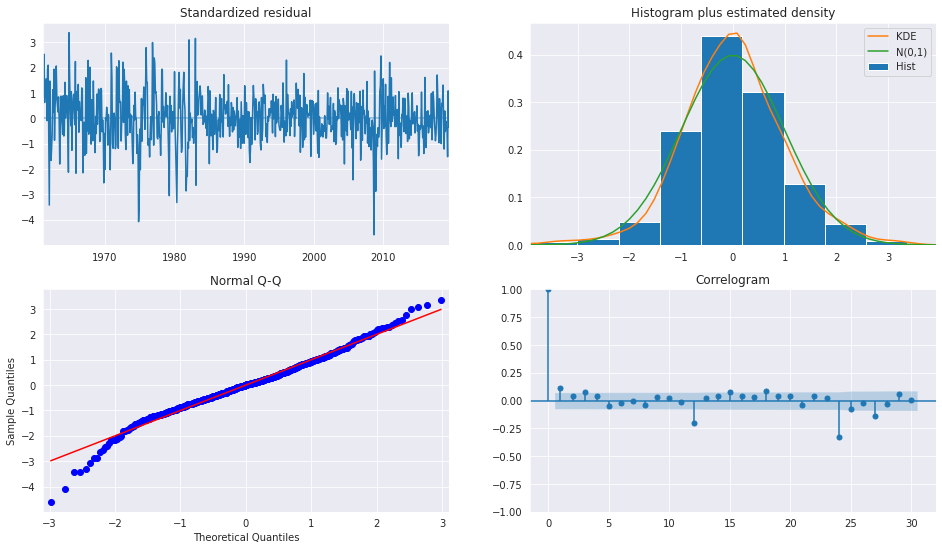

plot_diagnositcs indicates that the model captures the key features in the data.

[8]:

fig = plt.figure(figsize=(16,9))

fig = res.plot_diagnostics(fig=fig, lags=30)

Seasonal Dummies¶

AutoReg supports seasonal dummies which are an alternative way to model seasonality. Including the dummies shortens the dynamics to only an AR(2).

[9]:

sel = ar_select_order(housing, 13, seasonal=True, old_names=False)

sel.ar_lags

res = sel.model.fit()

print(res.summary())

AutoReg Model Results

==============================================================================

Dep. Variable: HOUSTNSA No. Observations: 725

Model: Seas. AutoReg(2) Log Likelihood -2652.556

Method: Conditional MLE S.D. of innovations 9.487

Date: Tue, 02 Feb 2021 AIC 4.541

Time: 06:54:41 BIC 4.636

Sample: 04-01-1959 HQIC 4.578

- 06-01-2019

===============================================================================

coef std err z P>|z| [0.025 0.975]

-------------------------------------------------------------------------------

const 1.2726 1.373 0.927 0.354 -1.418 3.963

s(2,12) 32.6477 1.824 17.901 0.000 29.073 36.222

s(3,12) 23.0685 2.435 9.472 0.000 18.295 27.842

s(4,12) 10.7267 2.693 3.983 0.000 5.449 16.005

s(5,12) 1.6792 2.100 0.799 0.424 -2.437 5.796

s(6,12) -4.4229 1.896 -2.333 0.020 -8.138 -0.707

s(7,12) -4.2113 1.824 -2.309 0.021 -7.786 -0.636

s(8,12) -6.4124 1.791 -3.581 0.000 -9.922 -2.902

s(9,12) 0.1095 1.800 0.061 0.952 -3.419 3.638

s(10,12) -16.7511 1.814 -9.234 0.000 -20.307 -13.196

s(11,12) -20.7023 1.862 -11.117 0.000 -24.352 -17.053

s(12,12) -11.9554 1.778 -6.724 0.000 -15.440 -8.470

HOUSTNSA.L1 -0.2953 0.037 -7.994 0.000 -0.368 -0.223

HOUSTNSA.L2 -0.1148 0.037 -3.107 0.002 -0.187 -0.042

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 -1.2862 -2.6564j 2.9514 -0.3218

AR.2 -1.2862 +2.6564j 2.9514 0.3218

-----------------------------------------------------------------------------

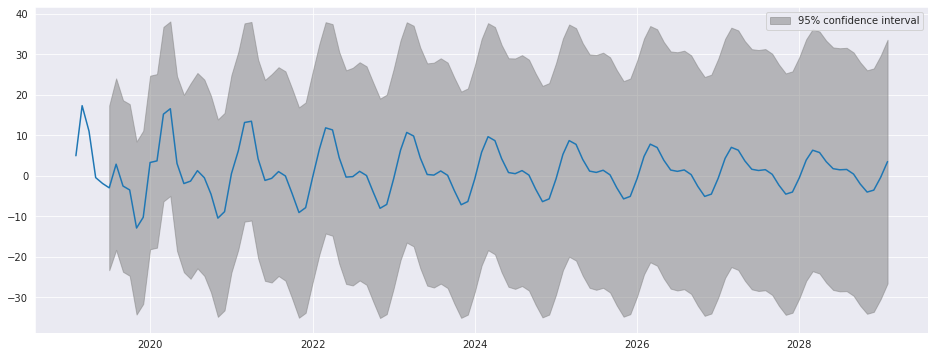

The seasonal dummies are obvious in the forecasts which has a non-trivial seasonal component in all periods 10 years in to the future.

[10]:

fig = res.plot_predict(720, 840)

[11]:

fig = plt.figure(figsize=(16,9))

fig = res.plot_diagnostics(lags=30, fig=fig)

Seasonal Dynamics¶

While AutoReg does not directly support Seasonal components since it uses OLS to estimate parameters, it is possible to capture seasonal dynamics using an over-parametrized Seasonal AR that does not impose the restrictions in the Seasonal AR.

[12]:

yoy_housing = data.HOUSTNSA.pct_change(12).resample("MS").last().dropna()

_, ax = plt.subplots()

ax = yoy_housing.plot(ax=ax)

We start by selecting a model using the simple method that only chooses the maximum lag. All lower lags are automatically included. The maximum lag to check is set to 13 since this allows the model to next a Seasonal AR that has both a short-run AR(1) component and a Seasonal AR(1) component, so that

when expanded. AutoReg does not enforce the structure, but can estimate the nesting model

We see that all 13 lags are selected.

[13]:

sel = ar_select_order(yoy_housing, 13, old_names=False)

sel.ar_lags

[13]:

array([ 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13])

It seems unlikely that all 13 lags are required. We can set glob=True to search all 213 models that include up to 13 lags.

Here we see that the first three are selected, as is the 7th, and finally the 12th and 13th are selected. This is superficially similar to the structure described above.

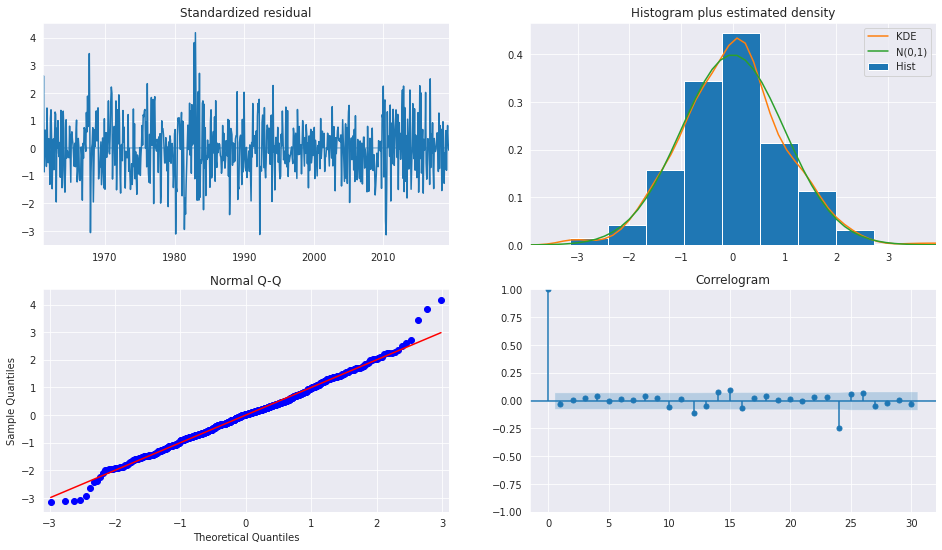

After fitting the model, we take a look at the diagnostic plots that indicate that this specification appears to be adequate to capture the dynamics in the data.

[14]:

sel = ar_select_order(yoy_housing, 13, glob=True, old_names=False)

sel.ar_lags

res = sel.model.fit()

print(res.summary())

AutoReg Model Results

==============================================================================

Dep. Variable: HOUSTNSA No. Observations: 714

Model: Restr. AutoReg(13) Log Likelihood 589.177

Method: Conditional MLE S.D. of innovations 0.104

Date: Tue, 02 Feb 2021 AIC -4.496

Time: 06:54:50 BIC -4.444

Sample: 02-01-1961 HQIC -4.476

- 06-01-2019

================================================================================

coef std err z P>|z| [0.025 0.975]

--------------------------------------------------------------------------------

const 0.0035 0.004 0.875 0.382 -0.004 0.011

HOUSTNSA.L1 0.5640 0.035 16.167 0.000 0.496 0.632

HOUSTNSA.L2 0.2347 0.038 6.238 0.000 0.161 0.308

HOUSTNSA.L3 0.2051 0.037 5.560 0.000 0.133 0.277

HOUSTNSA.L7 -0.0903 0.030 -2.976 0.003 -0.150 -0.031

HOUSTNSA.L12 -0.3791 0.034 -11.075 0.000 -0.446 -0.312

HOUSTNSA.L13 0.3354 0.033 10.254 0.000 0.271 0.400

Roots

==============================================================================

Real Imaginary Modulus Frequency

------------------------------------------------------------------------------

AR.1 -1.0309 -0.2682j 1.0652 -0.4595

AR.2 -1.0309 +0.2682j 1.0652 0.4595

AR.3 -0.7454 -0.7417j 1.0515 -0.3754

AR.4 -0.7454 +0.7417j 1.0515 0.3754

AR.5 -0.3172 -1.0221j 1.0702 -0.2979

AR.6 -0.3172 +1.0221j 1.0702 0.2979

AR.7 0.2419 -1.0573j 1.0846 -0.2142

AR.8 0.2419 +1.0573j 1.0846 0.2142

AR.9 0.7840 -0.8303j 1.1420 -0.1296

AR.10 0.7840 +0.8303j 1.1420 0.1296

AR.11 1.0730 -0.2386j 1.0992 -0.0348

AR.12 1.0730 +0.2386j 1.0992 0.0348

AR.13 1.1193 -0.0000j 1.1193 -0.0000

------------------------------------------------------------------------------

[15]:

fig = plt.figure(figsize=(16,9))

fig = res.plot_diagnostics(fig=fig, lags=30)

We can also include seasonal dummies. These are all insignificant since the model is using year-over-year changes.

[16]:

sel = ar_select_order(yoy_housing, 13, glob=True, seasonal=True, old_names=False)

sel.ar_lags

res = sel.model.fit()

print(res.summary())

AutoReg Model Results

====================================================================================

Dep. Variable: HOUSTNSA No. Observations: 714

Model: Restr. Seas. AutoReg(13) Log Likelihood 590.875

Method: Conditional MLE S.D. of innovations 0.104

Date: Tue, 02 Feb 2021 AIC -4.469

Time: 06:55:01 BIC -4.346

Sample: 02-01-1961 HQIC -4.422

- 06-01-2019

================================================================================

coef std err z P>|z| [0.025 0.975]

--------------------------------------------------------------------------------

const 0.0167 0.014 1.215 0.224 -0.010 0.044

s(2,12) -0.0179 0.019 -0.931 0.352 -0.056 0.020

s(3,12) -0.0121 0.019 -0.630 0.528 -0.050 0.026

s(4,12) -0.0210 0.019 -1.089 0.276 -0.059 0.017

s(5,12) -0.0223 0.019 -1.157 0.247 -0.060 0.015

s(6,12) -0.0224 0.019 -1.160 0.246 -0.060 0.015

s(7,12) -0.0212 0.019 -1.096 0.273 -0.059 0.017

s(8,12) -0.0101 0.019 -0.520 0.603 -0.048 0.028

s(9,12) -0.0095 0.019 -0.491 0.623 -0.047 0.028

s(10,12) -0.0049 0.019 -0.252 0.801 -0.043 0.033

s(11,12) -0.0084 0.019 -0.435 0.664 -0.046 0.030

s(12,12) -0.0077 0.019 -0.400 0.689 -0.046 0.030

HOUSTNSA.L1 0.5630 0.035 16.160 0.000 0.495 0.631

HOUSTNSA.L2 0.2347 0.038 6.248 0.000 0.161 0.308

HOUSTNSA.L3 0.2075 0.037 5.634 0.000 0.135 0.280

HOUSTNSA.L7 -0.0916 0.030 -3.013 0.003 -0.151 -0.032

HOUSTNSA.L12 -0.3810 0.034 -11.149 0.000 -0.448 -0.314

HOUSTNSA.L13 0.3373 0.033 10.327 0.000 0.273 0.401

Roots

==============================================================================

Real Imaginary Modulus Frequency

------------------------------------------------------------------------------

AR.1 -1.0305 -0.2681j 1.0648 -0.4595

AR.2 -1.0305 +0.2681j 1.0648 0.4595

AR.3 -0.7447 -0.7414j 1.0509 -0.3754

AR.4 -0.7447 +0.7414j 1.0509 0.3754

AR.5 -0.3172 -1.0215j 1.0696 -0.2979

AR.6 -0.3172 +1.0215j 1.0696 0.2979

AR.7 0.2416 -1.0568j 1.0841 -0.2142

AR.8 0.2416 +1.0568j 1.0841 0.2142

AR.9 0.7837 -0.8304j 1.1418 -0.1296

AR.10 0.7837 +0.8304j 1.1418 0.1296

AR.11 1.0724 -0.2383j 1.0986 -0.0348

AR.12 1.0724 +0.2383j 1.0986 0.0348

AR.13 1.1192 -0.0000j 1.1192 -0.0000

------------------------------------------------------------------------------

Industrial Production¶

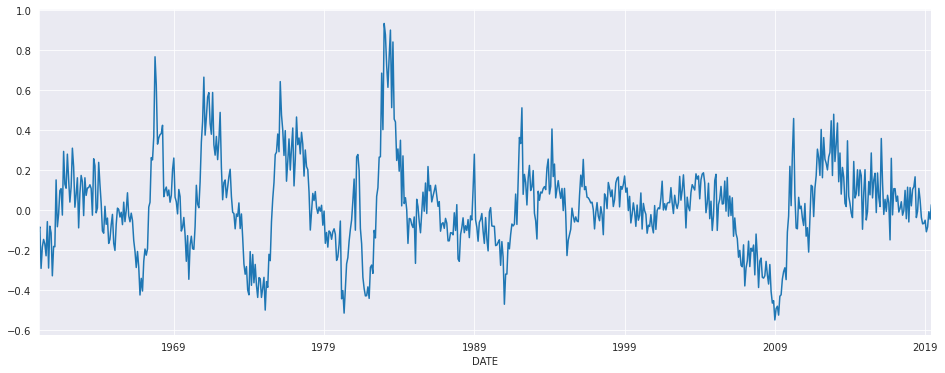

We will use the industrial production index data to examine forecasting.

[17]:

data = pdr.get_data_fred('INDPRO', '1959-01-01', '2019-06-01')

ind_prod = data.INDPRO.pct_change(12).dropna().asfreq('MS')

_, ax = plt.subplots(figsize=(16,9))

ind_prod.plot(ax=ax)

[17]:

<AxesSubplot:xlabel='DATE'>

We will start by selecting a model using up to 12 lags. An AR(13) minimizes the BIC criteria even though many coefficients are insignificant.

[18]:

sel = ar_select_order(ind_prod, 13, 'bic', old_names=False)

res = sel.model.fit()

print(res.summary())

AutoReg Model Results

==============================================================================

Dep. Variable: INDPRO No. Observations: 714

Model: AutoReg(13) Log Likelihood 2318.848

Method: Conditional MLE S.D. of innovations 0.009

Date: Tue, 02 Feb 2021 AIC -9.411

Time: 06:55:01 BIC -9.313

Sample: 02-01-1961 HQIC -9.373

- 06-01-2019

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 0.0012 0.000 2.896 0.004 0.000 0.002

INDPRO.L1 1.1504 0.035 32.940 0.000 1.082 1.219

INDPRO.L2 -0.0747 0.053 -1.407 0.159 -0.179 0.029

INDPRO.L3 0.0043 0.053 0.081 0.935 -0.099 0.107

INDPRO.L4 0.0027 0.053 0.052 0.959 -0.100 0.106

INDPRO.L5 -0.1383 0.052 -2.642 0.008 -0.241 -0.036

INDPRO.L6 0.0085 0.052 0.163 0.871 -0.094 0.111

INDPRO.L7 0.0375 0.052 0.720 0.471 -0.065 0.139

INDPRO.L8 -0.0235 0.052 -0.453 0.651 -0.125 0.078

INDPRO.L9 0.0945 0.052 1.824 0.068 -0.007 0.196

INDPRO.L10 -0.0844 0.052 -1.627 0.104 -0.186 0.017

INDPRO.L11 0.0024 0.052 0.047 0.962 -0.099 0.104

INDPRO.L12 -0.3809 0.052 -7.367 0.000 -0.482 -0.280

INDPRO.L13 0.3589 0.033 10.916 0.000 0.294 0.423

Roots

==============================================================================

Real Imaginary Modulus Frequency

------------------------------------------------------------------------------

AR.1 -1.0411 -0.2889j 1.0804 -0.4569

AR.2 -1.0411 +0.2889j 1.0804 0.4569

AR.3 -0.7774 -0.8064j 1.1201 -0.3721

AR.4 -0.7774 +0.8064j 1.1201 0.3721

AR.5 -0.2760 -1.0530j 1.0886 -0.2908

AR.6 -0.2760 +1.0530j 1.0886 0.2908

AR.7 0.2719 -1.0515j 1.0861 -0.2097

AR.8 0.2719 +1.0515j 1.0861 0.2097

AR.9 0.8019 -0.7297j 1.0842 -0.1175

AR.10 0.8019 +0.7297j 1.0842 0.1175

AR.11 1.0224 -0.2214j 1.0461 -0.0339

AR.12 1.0224 +0.2214j 1.0461 0.0339

AR.13 1.0578 -0.0000j 1.0578 -0.0000

------------------------------------------------------------------------------

We can also use a global search which allows longer lags to enter if needed without requiring the shorter lags. Here we see many lags dropped. The model indicates there may be some seasonality in the data.

[19]:

sel = ar_select_order(ind_prod, 13, 'bic', glob=True, old_names=False)

sel.ar_lags

res_glob = sel.model.fit()

print(res.summary())

AutoReg Model Results

==============================================================================

Dep. Variable: INDPRO No. Observations: 714

Model: AutoReg(13) Log Likelihood 2318.848

Method: Conditional MLE S.D. of innovations 0.009

Date: Tue, 02 Feb 2021 AIC -9.411

Time: 06:55:09 BIC -9.313

Sample: 02-01-1961 HQIC -9.373

- 06-01-2019

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 0.0012 0.000 2.896 0.004 0.000 0.002

INDPRO.L1 1.1504 0.035 32.940 0.000 1.082 1.219

INDPRO.L2 -0.0747 0.053 -1.407 0.159 -0.179 0.029

INDPRO.L3 0.0043 0.053 0.081 0.935 -0.099 0.107

INDPRO.L4 0.0027 0.053 0.052 0.959 -0.100 0.106

INDPRO.L5 -0.1383 0.052 -2.642 0.008 -0.241 -0.036

INDPRO.L6 0.0085 0.052 0.163 0.871 -0.094 0.111

INDPRO.L7 0.0375 0.052 0.720 0.471 -0.065 0.139

INDPRO.L8 -0.0235 0.052 -0.453 0.651 -0.125 0.078

INDPRO.L9 0.0945 0.052 1.824 0.068 -0.007 0.196

INDPRO.L10 -0.0844 0.052 -1.627 0.104 -0.186 0.017

INDPRO.L11 0.0024 0.052 0.047 0.962 -0.099 0.104

INDPRO.L12 -0.3809 0.052 -7.367 0.000 -0.482 -0.280

INDPRO.L13 0.3589 0.033 10.916 0.000 0.294 0.423

Roots

==============================================================================

Real Imaginary Modulus Frequency

------------------------------------------------------------------------------

AR.1 -1.0411 -0.2889j 1.0804 -0.4569

AR.2 -1.0411 +0.2889j 1.0804 0.4569

AR.3 -0.7774 -0.8064j 1.1201 -0.3721

AR.4 -0.7774 +0.8064j 1.1201 0.3721

AR.5 -0.2760 -1.0530j 1.0886 -0.2908

AR.6 -0.2760 +1.0530j 1.0886 0.2908

AR.7 0.2719 -1.0515j 1.0861 -0.2097

AR.8 0.2719 +1.0515j 1.0861 0.2097

AR.9 0.8019 -0.7297j 1.0842 -0.1175

AR.10 0.8019 +0.7297j 1.0842 0.1175

AR.11 1.0224 -0.2214j 1.0461 -0.0339

AR.12 1.0224 +0.2214j 1.0461 0.0339

AR.13 1.0578 -0.0000j 1.0578 -0.0000

------------------------------------------------------------------------------

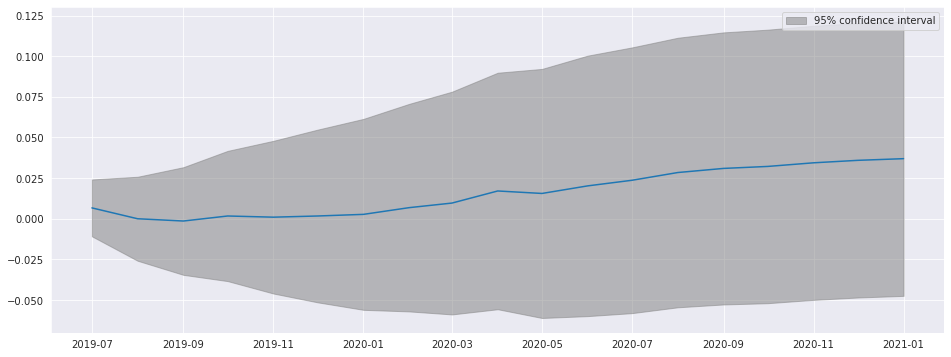

plot_predict can be used to produce forecast plots along with confidence intervals. Here we produce forecasts starting at the last observation and continuing for 18 months.

[20]:

ind_prod.shape

[20]:

(714,)

[21]:

fig = res_glob.plot_predict(start=714, end=732)

The forecasts from the full model and the restricted model are very similar. I also include an AR(5) which has very different dynamics

[22]:

res_ar5 = AutoReg(ind_prod, 5, old_names=False).fit()

predictions = pd.DataFrame({"AR(5)": res_ar5.predict(start=714, end=726),

"AR(13)": res.predict(start=714, end=726),

"Restr. AR(13)": res_glob.predict(start=714, end=726)})

_, ax = plt.subplots()

ax = predictions.plot(ax=ax)

The diagnostics indicate the model captures most of the the dynamics in the data. The ACF shows a patters at the seasonal frequency and so a more complete seasonal model (SARIMAX) may be needed.

[23]:

fig = plt.figure(figsize=(16,9))

fig = res_glob.plot_diagnostics(fig=fig, lags=30)

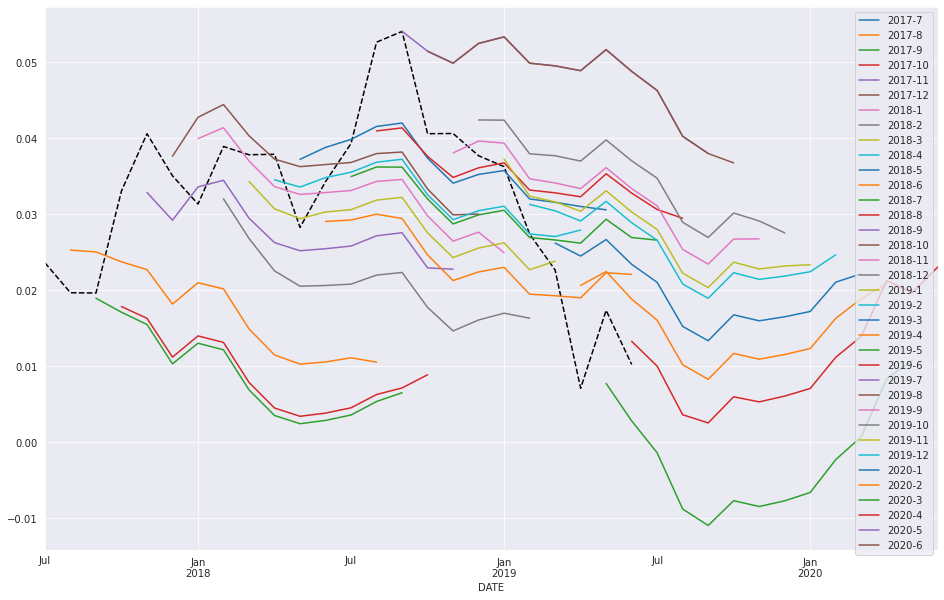

Forecasting¶

Forecasts are produced using the predict method from a results instance. The default produces static forecasts which are one-step forecasts. Producing multi-step forecasts requires using dynamic=True.

In this next cell, we produce 12-step-heard forecasts for the final 24 periods in the sample. This requires a loop.

Note: These are technically in-sample since the data we are forecasting was used to estimate parameters. Producing OOS forecasts requires two models. The first must exclude the OOS period. The second uses the predict method from the full-sample model with the parameters from the shorter sample model that excluded the OOS period.

[24]:

import numpy as np

start = ind_prod.index[-24]

forecast_index = pd.date_range(start, freq=ind_prod.index.freq, periods=36)

cols = ['-'.join(str(val) for val in (idx.year, idx.month)) for idx in forecast_index]

forecasts = pd.DataFrame(index=forecast_index,columns=cols)

for i in range(1, 24):

fcast = res_glob.predict(start=forecast_index[i], end=forecast_index[i+12], dynamic=True)

forecasts.loc[fcast.index, cols[i]] = fcast

_, ax = plt.subplots(figsize=(16, 10))

ind_prod.iloc[-24:].plot(ax=ax, color="black", linestyle="--")

ax = forecasts.plot(ax=ax)

Comparing to SARIMAX¶

SARIMAX is an implementation of a Seasonal Autoregressive Integrated Moving Average with eXogenous regressors model. It supports:

Specification of seasonal and nonseasonal AR and MA components

Inclusion of Exogenous variables

Full maximum-likelihood estimation using the Kalman Filter

This model is more feature rich than AutoReg. Unlike SARIMAX, AutoReg estimates parameters using OLS. This is faster and the problem is globally convex, and so there are no issues with local minima. The closed-form estimator and its performance are the key advantages of AutoReg over SARIMAX when comparing AR(P) models. AutoReg also support seasonal dummies, which can be used with SARIMAX if the user includes them as exogenous regressors.

[25]:

from statsmodels.tsa.api import SARIMAX

sarimax_mod = SARIMAX(ind_prod, order=((1,5,12,13),0, 0), trend='c')

sarimax_res = sarimax_mod.fit()

print(sarimax_res.summary())

SARIMAX Results

=========================================================================================

Dep. Variable: INDPRO No. Observations: 714

Model: SARIMAX([1, 5, 12, 13], 0, 0) Log Likelihood 2302.146

Date: Tue, 02 Feb 2021 AIC -4592.293

Time: 06:55:16 BIC -4564.867

Sample: 01-01-1960 HQIC -4581.701

- 06-01-2019

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

intercept 0.0011 0.000 2.627 0.009 0.000 0.002

ar.L1 1.0798 0.010 106.388 0.000 1.060 1.100

ar.L5 -0.0849 0.011 -7.467 0.000 -0.107 -0.063

ar.L12 -0.4392 0.026 -16.935 0.000 -0.490 -0.388

ar.L13 0.4032 0.025 15.831 0.000 0.353 0.453

sigma2 9.179e-05 3.13e-06 29.366 0.000 8.57e-05 9.79e-05

===================================================================================

Ljung-Box (L1) (Q): 19.65 Jarque-Bera (JB): 928.85

Prob(Q): 0.00 Prob(JB): 0.00

Heteroskedasticity (H): 0.38 Skew: -0.63

Prob(H) (two-sided): 0.00 Kurtosis: 8.44

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

[26]:

sarimax_params = sarimax_res.params.iloc[:-1].copy()

sarimax_params.index = res_glob.params.index

params = pd.concat([res_glob.params, sarimax_params], axis=1, sort=False)

params.columns = ["AutoReg", "SARIMAX"]

params

[26]:

| AutoReg | SARIMAX | |

|---|---|---|

| const | 0.001292 | 0.001140 |

| INDPRO.L1 | 1.088215 | 1.079829 |

| INDPRO.L5 | -0.105668 | -0.084904 |

| INDPRO.L12 | -0.385171 | -0.439175 |

| INDPRO.L13 | 0.358738 | 0.403241 |

Custom Deterministic Processes¶

The deterministic parameter allows a custom DeterministicProcess to be used. This allows for more complex deterministic terms to be constructed, for example one that includes seasonal components with two periods, or, as the next example shows, one that uses a Fourier series rather than seasonal dummies.

[27]:

from statsmodels.tsa.deterministic import DeterministicProcess

dp = DeterministicProcess(housing.index, constant=True, period=12, fourier=2)

mod = AutoReg(housing,2, trend="n",seasonal=False, deterministic=dp)

res = mod.fit()

print(res.summary())

AutoReg Model Results

==============================================================================

Dep. Variable: HOUSTNSA No. Observations: 725

Model: AutoReg(2) Log Likelihood -2716.505

Method: Conditional MLE S.D. of innovations 10.364

Date: Tue, 02 Feb 2021 AIC 4.699

Time: 06:55:16 BIC 4.750

Sample: 04-01-1959 HQIC 4.718

- 06-01-2019

===============================================================================

coef std err z P>|z| [0.025 0.975]

-------------------------------------------------------------------------------

const 1.7550 0.391 4.485 0.000 0.988 2.522

sin(1,12) 16.7443 0.860 19.478 0.000 15.059 18.429

cos(1,12) 4.9409 0.588 8.409 0.000 3.789 6.093

sin(2,12) 12.9364 0.619 20.889 0.000 11.723 14.150

cos(2,12) -0.4738 0.754 -0.628 0.530 -1.952 1.004

HOUSTNSA.L1 -0.3905 0.037 -10.664 0.000 -0.462 -0.319

HOUSTNSA.L2 -0.1746 0.037 -4.769 0.000 -0.246 -0.103

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 -1.1182 -2.1159j 2.3932 -0.3274

AR.2 -1.1182 +2.1159j 2.3932 0.3274

-----------------------------------------------------------------------------

[28]:

fig = res.plot_predict(720, 840)