The Theta Model¶

The Theta model of Assimakopoulos & Nikolopoulos (2000) is a simple method for forecasting the involves fitting two θ-lines, forecasting the lines using a Simple Exponential Smoother, and then combining the forecasts from the two lines to produce the final forecast. The model is implemented in steps:

Test for seasonality

Deseasonalize if seasonality detected

Estimate α by fitting a SES model to the data and b0 by OLS.

Forecast the series

Reseasonalize if the data was deseasonalized.

The seasonality test examines the ACF at the seasonal lag m. If this lag is significantly different from zero then the data is deseasonalize using statsmodels.tsa.seasonal_decompose use either a multiplicative method (default) or additive.

The parameters of the model are b0 and α where b0 is estimated from the OLS regression

and α is the SES smoothing parameter in

The forecasts are then

Ultimately θ only plays a role in determining how much the trend is damped. If θ is very large, then the forecast of the model is identical to that from an Integrated Moving Average with a drift,

Finally, the forecasts are reseasonalized if needed.

This module is based on:

Assimakopoulos, V., & Nikolopoulos, K. (2000). The theta model: a decomposition approach to forecasting. International journal of forecasting, 16(4), 521-530.

Hyndman, R. J., & Billah, B. (2003). Unmasking the Theta method. International Journal of Forecasting, 19(2), 287-290.

Fioruci, J. A., Pellegrini, T. R., Louzada, F., & Petropoulos, F. (2015). The optimized theta method. arXiv preprint arXiv:1503.03529.

Imports¶

We start with the standard set of imports and some tweaks to the default matplotlib style.

[1]:

import numpy as np

import pandas as pd

import pandas_datareader as pdr

import matplotlib.pyplot as plt

import seaborn as sns

plt.rc("figure",figsize=(16,8))

plt.rc("font",size=15)

plt.rc("lines",linewidth=3)

sns.set_style("darkgrid")

Load some Data¶

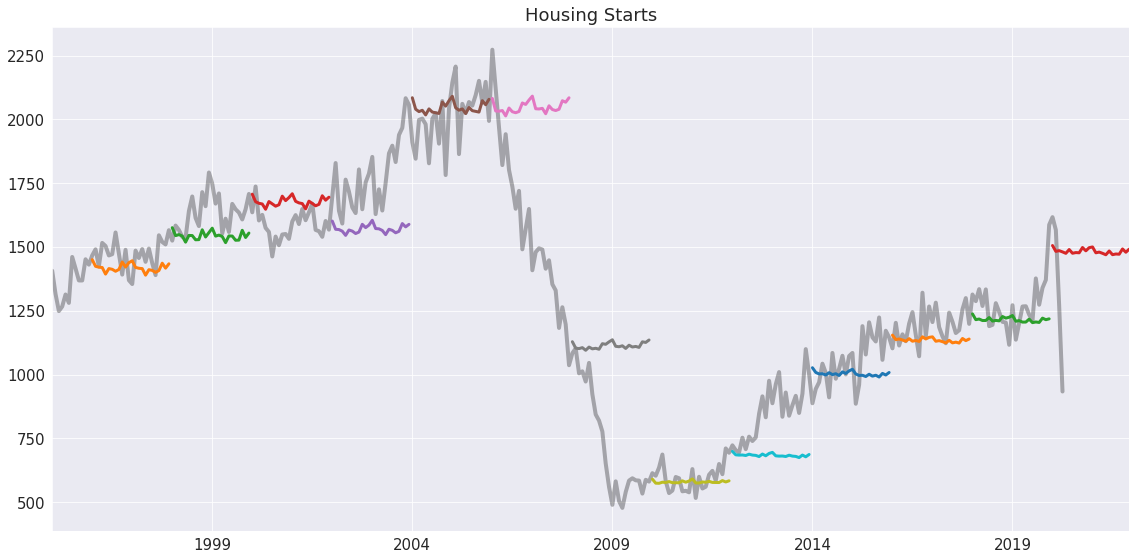

We will first look at housing starts using US data. This series is clearly seasonal but does not have a clear trend during the same.

[2]:

reader = pdr.fred.FredReader(["HOUST"], start="1980-01-01", end="2020-04-01")

data = reader.read()

housing = data.HOUST

housing.index.freq = housing.index.inferred_freq

ax = housing.plot()

We fit specify the model without any options and fit it. The summary shows that the data was deseasonalized using the multiplicative method. The drift is modest and negative, and the smoothing parameter is fairly low.

[3]:

from statsmodels.tsa.forecasting.theta import ThetaModel

tm = ThetaModel(housing)

res = tm.fit()

print(res.summary())

ThetaModel Results

==============================================================================

Dep. Variable: HOUST No. Observations: 484

Method: OLS/SES Deseasonalized: True

Date: Tue, 02 Feb 2021 Deseas. Method: Multiplicative

Time: 06:51:15 Period: 12

Sample: 01-01-1980

- 04-01-2020

Parameter Estimates

=========================

Parameters

-------------------------

b0 -0.9151736454223132

alpha 0.6172836576667062

-------------------------

The model is first and foremost a forecasting method. Forecasts are produced using the forecast method from fitted model. Below we produce a hedgehog plot by forecasting 2-years ahead every 2 years.

Note: the default θ is 2.

[4]:

forecasts = {"housing": housing}

for year in range(1995, 2020, 2):

sub = housing[:str(year)]

res = ThetaModel(sub).fit()

fcast = res.forecast(24)

forecasts[str(year)] = fcast

forecasts = pd.DataFrame(forecasts)

ax = forecasts["1995":].plot(legend=False)

children = ax.get_children()

children[0].set_linewidth(4)

children[0].set_alpha(0.3)

children[0].set_color("#000000")

ax.set_title("Housing Starts")

plt.tight_layout(pad=1.0)

We could alternatively fir the log of the data. Here it makes more sense to force the deseasonalizing to use the additive method, if needed. We also fit the model parameters using MLE. This method fits the IMA

where ˆα = min using statsmodels.tsa.SARIMAX. The parameters are similar although the drift is closer to zero.

[5]:

tm = ThetaModel(np.log(housing), method="additive")

res = tm.fit(use_mle=True)

print(res.summary())

ThetaModel Results

==============================================================================

Dep. Variable: HOUST No. Observations: 484

Method: MLE Deseasonalized: True

Date: Tue, 02 Feb 2021 Deseas. Method: Additive

Time: 06:51:17 Period: 12

Sample: 01-01-1980

- 04-01-2020

Parameter Estimates

============================

Parameters

----------------------------

b0 -0.0004287968562346969

alpha 0.670779164417624

----------------------------

The forecast only depends on the forecast trend component,

the forecast from the SES (which does not change with the horizon), and the seasonal. These three components are available using the forecast_components. This allows forecasts to be constructed using multiple choices of \theta using the weight expression above.

[6]:

res.forecast_components(12)

[6]:

| trend | ses | seasonal | |

|---|---|---|---|

| 2020-05-01 | -0.000639 | 6.964501 | -0.007320 |

| 2020-06-01 | -0.001068 | 6.964501 | 0.002210 |

| 2020-07-01 | -0.001497 | 6.964501 | -0.004322 |

| 2020-08-01 | -0.001926 | 6.964501 | -0.004915 |

| 2020-09-01 | -0.002354 | 6.964501 | -0.004035 |

| 2020-10-01 | -0.002783 | 6.964501 | 0.009697 |

| 2020-11-01 | -0.003212 | 6.964501 | 0.000508 |

| 2020-12-01 | -0.003641 | 6.964501 | 0.007040 |

| 2021-01-01 | -0.004070 | 6.964501 | 0.010268 |

| 2021-02-01 | -0.004498 | 6.964501 | -0.003951 |

| 2021-03-01 | -0.004927 | 6.964501 | -0.001849 |

| 2021-04-01 | -0.005356 | 6.964501 | -0.003331 |

Personal Consumption Expenditure¶

We next look at personal consumption expenditure. This series has a clear seasonal component and a drift.

[7]:

reader = pdr.fred.FredReader(["NA000349Q"], start="1980-01-01", end="2020-04-01")

pce = reader.read()

pce.columns = ["PCE"]

_ = pce.plot()

Since this series is always positive, we model the \ln.

[8]:

mod = ThetaModel(np.log(pce))

res = mod.fit()

print(res.summary())

ThetaModel Results

==============================================================================

Dep. Variable: PCE No. Observations: 162

Method: OLS/SES Deseasonalized: True

Date: Tue, 02 Feb 2021 Deseas. Method: Multiplicative

Time: 06:51:18 Period: 4

Sample: 01-01-1980

- 04-01-2020

Parameter Estimates

==========================

Parameters

--------------------------

b0 0.013026405758310324

alpha 0.9998844241635727

--------------------------

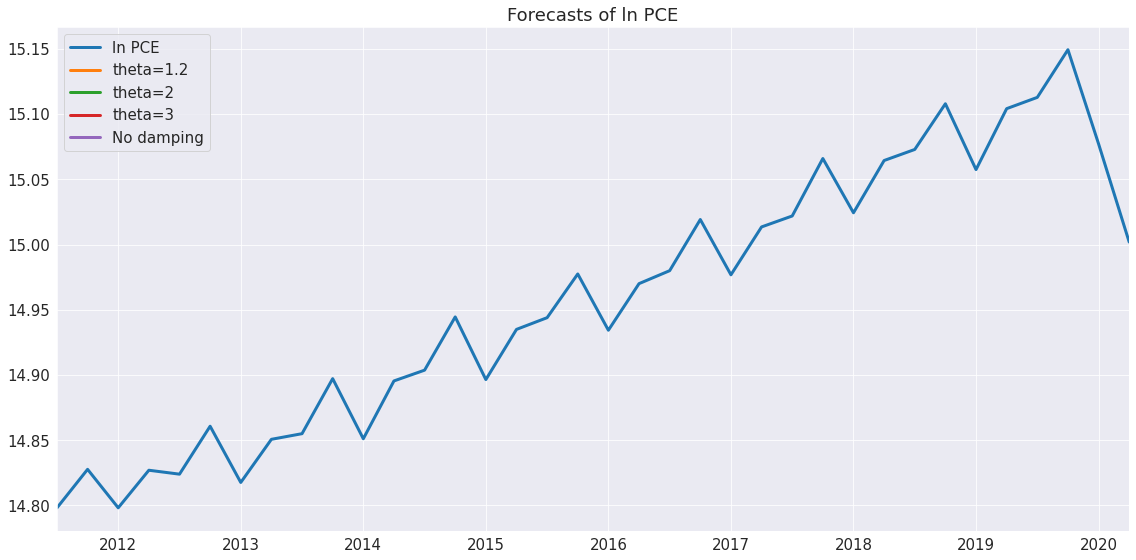

Next we explore differenced in the forecast as \theta changes. When \theta is close to 1, the drift is nearly absent. As \theta increases, the drift becomes more obvious.

[9]:

forecasts = pd.DataFrame({"ln PCE":np.log(pce.PCE),

"theta=1.2": res.forecast(12, theta=1.2),

"theta=2": res.forecast(12),

"theta=3": res.forecast(12, theta=3),

"No damping": res.forecast(12, theta=np.inf)

})

_ = forecasts.tail(36).plot()

plt.title("Forecasts of ln PCE")

plt.tight_layout(pad=1.0)

/home/travis/build/statsmodels/statsmodels/statsmodels/tsa/deterministic.py:152: UserWarning: Only PeriodIndexes, DatetimeIndexes with a frequency set, RangesIndexes, and Int64Indexes with a unit increment support extending. The index is set will contain the position relative to the data length.

UserWarning,

Finally, plot_predict can be used to visualize the predictions and prediction intervals which are constructed assuming the IMA is true.

[10]:

ax = res.plot_predict(24, theta=2)

/home/travis/build/statsmodels/statsmodels/statsmodels/tsa/deterministic.py:152: UserWarning: Only PeriodIndexes, DatetimeIndexes with a frequency set, RangesIndexes, and Int64Indexes with a unit increment support extending. The index is set will contain the position relative to the data length.

UserWarning,

/home/travis/build/statsmodels/statsmodels/statsmodels/tsa/deterministic.py:152: UserWarning: Only PeriodIndexes, DatetimeIndexes with a frequency set, RangesIndexes, and Int64Indexes with a unit increment support extending. The index is set will contain the position relative to the data length.

UserWarning,

We conclude be producing a hedgehog plot using 2-year non-overlapping samples.

[11]:

ln_pce = np.log(pce.PCE)

forecasts = {"ln PCE": ln_pce}

for year in range(1995,2020,3):

sub = ln_pce[:str(year)]

res = ThetaModel(sub).fit()

fcast = res.forecast(12)

forecasts[str(year)] = fcast

forecasts = pd.DataFrame(forecasts)

ax = forecasts["1995":].plot(legend=False)

children = ax.get_children()

children[0].set_linewidth(4)

children[0].set_alpha(0.3)

children[0].set_color("#000000")

ax.set_title("ln PCE")

plt.tight_layout(pad=1.0)