ETS models¶

The ETS models are a family of time series models with an underlying state space model consisting of a level component, a trend component (T), a seasonal component (S), and an error term (E).

This notebook shows how they can be used with statsmodels. For a more thorough treatment we refer to [1], chapter 8 (free online resource), on which the implementation in statsmodels and the examples used in this notebook are based.

statsmodels implements all combinations of: - additive and multiplicative error model - additive and multiplicative trend, possibly dampened - additive and multiplicative seasonality

However, not all of these methods are stable. Refer to [1] and references therein for more info about model stability.

[1] Hyndman, Rob J., and George Athanasopoulos. Forecasting: principles and practice, 3rd edition, OTexts, 2019. https://www.otexts.org/fpp3/7

[1]:

import numpy as np

import matplotlib.pyplot as plt

import pandas as pd

%matplotlib inline

from statsmodels.tsa.exponential_smoothing.ets import ETSModel

[2]:

plt.rcParams['figure.figsize'] = (12, 8)

Simple exponential smoothing¶

The simplest of the ETS models is also known as simple exponential smoothing. In ETS terms, it corresponds to the (A, N, N) model, that is, a model with additive errors, no trend, and no seasonality. The state space formulation of Holt’s method is:

This state space formulation can be turned into a different formulation, a forecast and a smoothing equation (as can be done with all ETS models):

Here, \(\hat{y}_{t|t-1}\) is the forecast/expectation of \(y_t\) given the information of the previous step. In the simple exponential smoothing model, the forecast corresponds to the previous level. The second equation (smoothing equation) calculates the next level as weighted average of the previous level and the previous observation.

[3]:

oildata = [

111.0091, 130.8284, 141.2871, 154.2278,

162.7409, 192.1665, 240.7997, 304.2174,

384.0046, 429.6622, 359.3169, 437.2519,

468.4008, 424.4353, 487.9794, 509.8284,

506.3473, 340.1842, 240.2589, 219.0328,

172.0747, 252.5901, 221.0711, 276.5188,

271.1480, 342.6186, 428.3558, 442.3946,

432.7851, 437.2497, 437.2092, 445.3641,

453.1950, 454.4096, 422.3789, 456.0371,

440.3866, 425.1944, 486.2052, 500.4291,

521.2759, 508.9476, 488.8889, 509.8706,

456.7229, 473.8166, 525.9509, 549.8338,

542.3405

]

oil = pd.Series(oildata, index=pd.date_range('1965', '2013', freq='AS'))

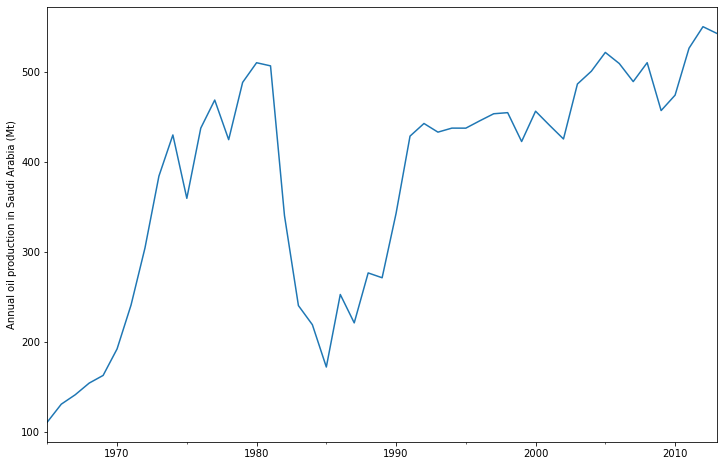

oil.plot()

plt.ylabel("Annual oil production in Saudi Arabia (Mt)");

[3]:

Text(0, 0.5, 'Annual oil production in Saudi Arabia (Mt)')

The plot above shows annual oil production in Saudi Arabia in million tonnes. The data are taken from the R package fpp2 (companion package to prior version [1]). Below you can see how to fit a simple exponential smoothing model using statsmodels’s ETS implementation to this data. Additionally, the fit using forecast in R is shown as comparison.

[4]:

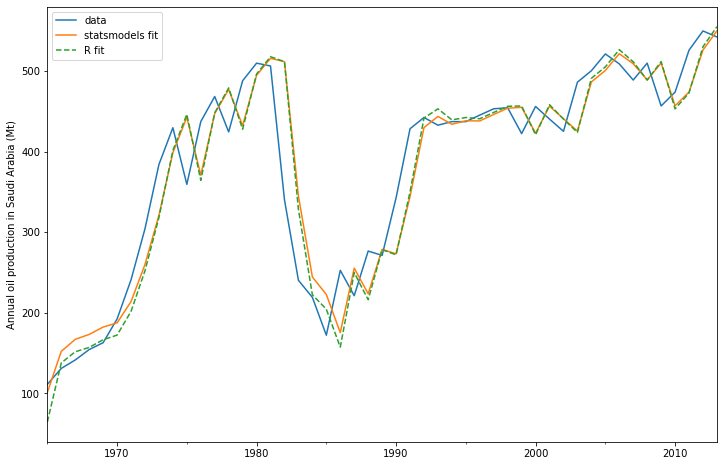

model = ETSModel(oil, error='add', trend='add', damped_trend=True)

fit = model.fit(maxiter=10000)

oil.plot(label='data')

fit.fittedvalues.plot(label='statsmodels fit')

plt.ylabel("Annual oil production in Saudi Arabia (Mt)");

# obtained from R

params_R = [0.99989969, 0.11888177503085334, 0.80000197, 36.46466837, 34.72584983]

yhat = model.smooth(params_R).fittedvalues

yhat.plot(label='R fit', linestyle='--')

plt.legend();

[4]:

<matplotlib.legend.Legend at 0x7ff29caa8310>

By default the initial states are considered to be fitting parameters and are estimated by maximizing log-likelihood. Additionally it is possible to only use a heuristic for the initial values. In this case this leads to better agreement with the R implementation.

[5]:

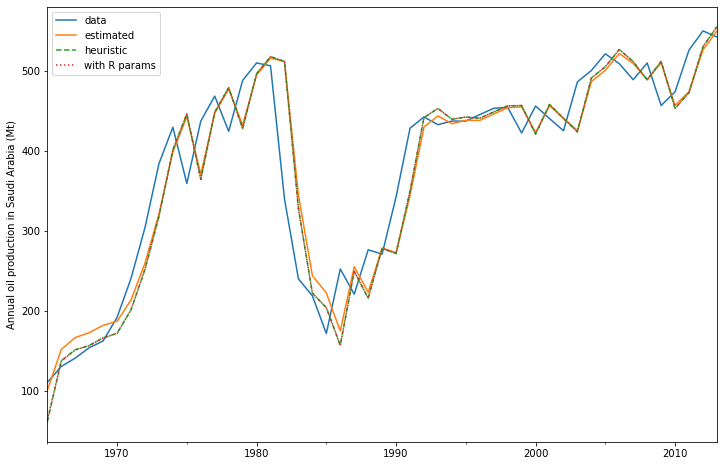

model_heuristic = ETSModel(oil, error='add', trend='add', damped_trend=True,

initialization_method='heuristic')

fit_heuristic = model_heuristic.fit()

oil.plot(label='data')

fit.fittedvalues.plot(label='estimated')

fit_heuristic.fittedvalues.plot(label='heuristic', linestyle='--')

plt.ylabel("Annual oil production in Saudi Arabia (Mt)");

# obtained from R

params = [0.99989969, 0.11888177503085334, 0.80000197, 36.46466837, 34.72584983]

yhat = model.smooth(params).fittedvalues

yhat.plot(label='with R params', linestyle=':')

plt.legend();

[5]:

<matplotlib.legend.Legend at 0x7ff29ca19c90>

The fitted parameters and some other measures are shown using fit.summary(). Here we can see that the log-likelihood of the model using fitted initial states is a bit lower than the one using a heuristic for the initial states. Additionally, we see that \(\beta\) (smoothing_trend) is at the boundary of the default parameter bounds, and therefore it’s not possible to estimate confidence intervals for \(\beta\).

[6]:

print(fit.summary())

ETS Results

==============================================================================

Dep. Variable: y No. Observations: 49

Model: ETS(AAdN) Log Likelihood -258.108

Date: Tue, 02 Feb 2021 AIC 528.216

Time: 07:02:07 BIC 539.567

Sample: 01-01-1965 HQIC 532.523

- 01-01-2013 Scale 2202.048

Covariance Type: approx

===================================================================================

coef std err z P>|z| [0.025 0.975]

-----------------------------------------------------------------------------------

smoothing_level 0.9999 0.136 7.326 0.000 0.732 1.267

smoothing_trend 9.999e-05 nan nan nan nan nan

damping_trend 0.8798 0.059 14.901 0.000 0.764 0.996

initial_level 54.2331 55.750 0.973 0.331 -55.034 163.500

initial_trend 52.9975 34.392 1.541 0.123 -14.409 120.404

===================================================================================

Ljung-Box (Q): 1.42 Jarque-Bera (JB): 20.73

Prob(Q): 0.49 Prob(JB): 0.00

Heteroskedasticity (H): 0.52 Skew: -1.02

Prob(H) (two-sided): 0.20 Kurtosis: 5.45

===================================================================================

Warnings:

[1] Covariance matrix calculated using numerical (complex-step) differentiation.

[7]:

print(fit_heuristic.summary())

ETS Results

==============================================================================

Dep. Variable: y No. Observations: 49

Model: ETS(AAdN) Log Likelihood -258.881

Date: Tue, 02 Feb 2021 AIC 525.761

Time: 07:02:08 BIC 533.328

Sample: 01-01-1965 HQIC 528.632

- 01-01-2013 Scale 2272.587

Covariance Type: approx

===================================================================================

coef std err z P>|z| [0.025 0.975]

-----------------------------------------------------------------------------------

smoothing_level 0.9999 0.097 10.289 0.000 0.809 1.190

smoothing_trend 0.1183 nan nan nan nan nan

damping_trend 0.8000 nan nan nan nan nan

==============================================

initialization method: heuristic

----------------------------------------------

initial_level 33.6309

initial_trend 34.8115

===================================================================================

Ljung-Box (Q): 0.27 Jarque-Bera (JB): 19.93

Prob(Q): 0.88 Prob(JB): 0.00

Heteroskedasticity (H): 0.50 Skew: -0.95

Prob(H) (two-sided): 0.18 Kurtosis: 5.48

===================================================================================

Warnings:

[1] Covariance matrix calculated using numerical (complex-step) differentiation.

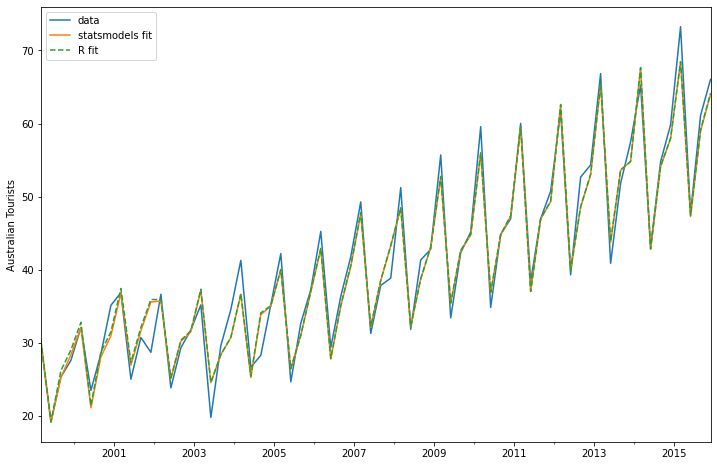

Holt-Winters’ seasonal method¶

The exponential smoothing method can be modified to incorporate a trend and a seasonal component. In the additive Holt-Winters’ method, the seasonal component is added to the rest. This model corresponds to the ETS(A, A, A) model, and has the following state space formulation:

[8]:

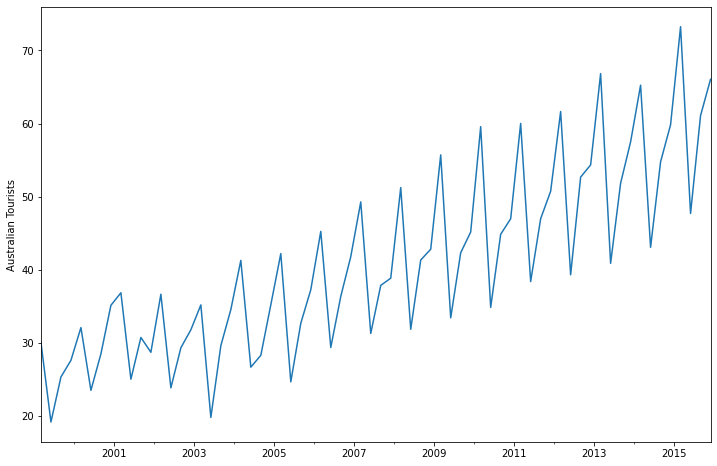

austourists_data = [

30.05251300, 19.14849600, 25.31769200, 27.59143700,

32.07645600, 23.48796100, 28.47594000, 35.12375300,

36.83848500, 25.00701700, 30.72223000, 28.69375900,

36.64098600, 23.82460900, 29.31168300, 31.77030900,

35.17787700, 19.77524400, 29.60175000, 34.53884200,

41.27359900, 26.65586200, 28.27985900, 35.19115300,

42.20566386, 24.64917133, 32.66733514, 37.25735401,

45.24246027, 29.35048127, 36.34420728, 41.78208136,

49.27659843, 31.27540139, 37.85062549, 38.83704413,

51.23690034, 31.83855162, 41.32342126, 42.79900337,

55.70835836, 33.40714492, 42.31663797, 45.15712257,

59.57607996, 34.83733016, 44.84168072, 46.97124960,

60.01903094, 38.37117851, 46.97586413, 50.73379646,

61.64687319, 39.29956937, 52.67120908, 54.33231689,

66.83435838, 40.87118847, 51.82853579, 57.49190993,

65.25146985, 43.06120822, 54.76075713, 59.83447494,

73.25702747, 47.69662373, 61.09776802, 66.05576122,

]

index = pd.date_range("1999-03-01", "2015-12-01", freq="3MS")

austourists = pd.Series(austourists_data, index=index)

austourists.plot()

plt.ylabel('Australian Tourists');

[8]:

Text(0, 0.5, 'Australian Tourists')

[9]:

# fit in statsmodels

model = ETSModel(austourists, error="add", trend="add", seasonal="add",

damped_trend=True, seasonal_periods=4)

fit = model.fit()

# fit with R params

params_R = [

0.35445427, 0.03200749, 0.39993387, 0.97999997, 24.01278357,

0.97770147, 1.76951063, -0.50735902, -6.61171798, 5.34956637

]

fit_R = model.smooth(params_R)

austourists.plot(label='data')

plt.ylabel('Australian Tourists')

fit.fittedvalues.plot(label='statsmodels fit')

fit_R.fittedvalues.plot(label='R fit', linestyle='--')

plt.legend();

[9]:

<matplotlib.legend.Legend at 0x7ff29abc2bd0>

[10]:

print(fit.summary())

ETS Results

==============================================================================

Dep. Variable: y No. Observations: 68

Model: ETS(AAdA) Log Likelihood -152.627

Date: Tue, 02 Feb 2021 AIC 327.254

Time: 07:02:10 BIC 351.668

Sample: 03-01-1999 HQIC 336.928

- 12-01-2015 Scale 5.213

Covariance Type: approx

======================================================================================

coef std err z P>|z| [0.025 0.975]

--------------------------------------------------------------------------------------

smoothing_level 0.3398 0.111 3.070 0.002 0.123 0.557

smoothing_trend 0.0259 0.008 3.158 0.002 0.010 0.042

smoothing_seasonal 0.4010 0.080 5.041 0.000 0.245 0.557

damping_trend 0.9800 nan nan nan nan nan

initial_level 29.4475 2.92e+04 0.001 0.999 -5.72e+04 5.72e+04

initial_trend 0.6147 0.392 1.567 0.117 -0.154 1.383

initial_seasonal.0 -3.4379 2.92e+04 -0.000 1.000 -5.72e+04 5.72e+04

initial_seasonal.1 -5.9571 2.92e+04 -0.000 1.000 -5.72e+04 5.72e+04

initial_seasonal.2 -11.4881 2.92e+04 -0.000 1.000 -5.72e+04 5.72e+04

initial_seasonal.3 0 2.92e+04 0 1.000 -5.72e+04 5.72e+04

===================================================================================

Ljung-Box (Q): 5.76 Jarque-Bera (JB): 7.69

Prob(Q): 0.67 Prob(JB): 0.02

Heteroskedasticity (H): 0.46 Skew: -0.63

Prob(H) (two-sided): 0.07 Kurtosis: 4.05

===================================================================================

Warnings:

[1] Covariance matrix calculated using numerical (complex-step) differentiation.

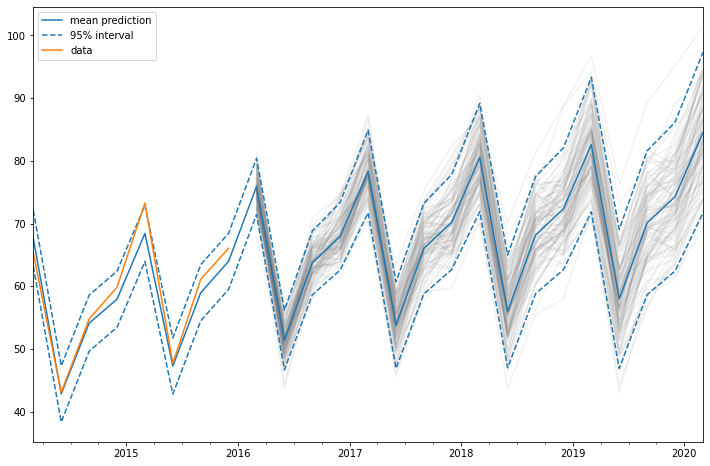

Predictions¶

The ETS model can also be used for predicting. There are several different methods available: - forecast: makes out of sample predictions - predict: in sample and out of sample predictions - simulate: runs simulations of the statespace model - get_prediction: in sample and out of sample predictions, as well as prediction intervals

We can use them on our previously fitted model to predict from 2014 to 2020.

[11]:

pred = fit.get_prediction(start='2014', end='2020')

[12]:

df = pred.summary_frame(alpha=0.05)

df

[12]:

| mean | pi_lower | pi_upper | |

|---|---|---|---|

| 2014-03-01 | 67.611048 | 63.136076 | 72.086020 |

| 2014-06-01 | 42.814811 | 38.339839 | 47.289783 |

| 2014-09-01 | 54.106462 | 49.631490 | 58.581434 |

| 2014-12-01 | 57.928276 | 53.453304 | 62.403248 |

| 2015-03-01 | 68.422079 | 63.947107 | 72.897051 |

| 2015-06-01 | 47.277849 | 42.802877 | 51.752821 |

| 2015-09-01 | 58.954740 | 54.479768 | 63.429712 |

| 2015-12-01 | 63.982155 | 59.507183 | 68.457127 |

| 2016-03-01 | 75.905268 | 71.430295 | 80.380240 |

| 2016-06-01 | 51.418122 | 46.654016 | 56.182228 |

| 2016-09-01 | 63.703292 | 58.629393 | 68.777191 |

| 2016-12-01 | 67.978107 | 62.575778 | 73.380436 |

| 2017-03-01 | 78.315764 | 71.735800 | 84.895727 |

| 2017-06-01 | 53.780408 | 46.883520 | 60.677296 |

| 2017-09-01 | 66.018333 | 58.788303 | 73.248362 |

| 2017-12-01 | 70.246847 | 62.668821 | 77.824872 |

| 2018-03-01 | 80.539128 | 71.892785 | 89.185471 |

| 2018-06-01 | 55.959305 | 46.968347 | 64.950264 |

| 2018-09-01 | 68.153652 | 58.805308 | 77.501996 |

| 2018-12-01 | 72.339460 | 62.621963 | 82.056957 |

| 2019-03-01 | 82.589889 | 71.864783 | 93.314995 |

| 2019-06-01 | 57.969051 | 46.876058 | 69.062044 |

| 2019-09-01 | 70.123203 | 58.652201 | 81.594204 |

| 2019-12-01 | 74.269620 | 62.411255 | 86.127984 |

| 2020-03-01 | 84.481446 | 71.656450 | 97.306441 |

In this case the prediction intervals were calculated using an analytical formula. This is not available for all models. For these other models, prediction intervals are calculated by performing multiple simulations (1000 by default) and using the percentiles of the simulation results. This is done internally by the get_prediction method.

We can also manually run simulations, e.g. to plot them. Since the data ranges until end of 2015, we have to simulate from the first quarter of 2016 to the first quarter of 2020, which means 17 steps.

[13]:

simulated = fit.simulate(anchor="end", nsimulations=17, repetitions=100)

[14]:

for i in range(simulated.shape[1]):

simulated.iloc[:,i].plot(label='_', color='gray', alpha=0.1)

df["mean"].plot(label='mean prediction')

df["pi_lower"].plot(linestyle='--', color='tab:blue', label='95% interval')

df["pi_upper"].plot(linestyle='--', color='tab:blue', label='_')

pred.endog.plot(label='data')

plt.legend()

[14]:

<matplotlib.legend.Legend at 0x7ff29c8541d0>

In this case, we chose “end” as simulation anchor, which means that the first simulated value will be the first out of sample value. It is also possible to choose other anchor inside the sample.

[ ]: