SARIMAX and ARIMA: Frequently Asked Questions (FAQ)¶

This notebook contains explanations for frequently asked questions.

Comparing trends and exogenous variables in

SARIMAX,ARIMAandAutoRegReconstructing residuals, fitted values and forecasts in

SARIMAXandARIMAInitial residuals in

SARIMAXandARIMA

Comparing trends and exogenous variables in SARIMAX, ARIMA and AutoReg¶

ARIMA are formally OLS with ARMA errors. A basic AR(1) in the OLS with ARMA errors is described as

In large samples,

SARIMAX uses a different representation, so that the model when estimated using SARIMAX is

This is the same representation that is used when the model is estimated using OLS (AutoReg). In large samples,

In the next cell, we simulate a large sample and verify that these relationship hold in practice.

[1]:

%matplotlib inline

[2]:

import numpy as np

import pandas as pd

rng = np.random.default_rng(20210819)

eta = rng.standard_normal(5200)

rho = 0.8

beta = 10

epsilon = eta.copy()

for i in range(1, eta.shape[0]):

epsilon[i] = rho * epsilon[i - 1] + eta[i]

y = beta + epsilon

y = y[200:]

[3]:

from statsmodels.tsa.api import SARIMAX, AutoReg

from statsmodels.tsa.arima.model import ARIMA

The three models are specified and estimated in the next cell. An AR(0) is included as a reference. The AR(0) is identical using all three estimators.

[4]:

ar0_res = SARIMAX(y, order=(0, 0, 0), trend="c").fit()

sarimax_res = SARIMAX(y, order=(1, 0, 0), trend="c").fit()

arima_res = ARIMA(y, order=(1, 0, 0), trend="c").fit()

autoreg_res = AutoReg(y, 1, trend="c").fit()

This problem is unconstrained.

This problem is unconstrained.

RUNNING THE L-BFGS-B CODE

* * *

Machine precision = 2.220D-16

N = 2 M = 10

At X0 0 variables are exactly at the bounds

At iterate 0 f= 1.91760D+00 |proj g|= 3.68860D-06

* * *

Tit = total number of iterations

Tnf = total number of function evaluations

Tnint = total number of segments explored during Cauchy searches

Skip = number of BFGS updates skipped

Nact = number of active bounds at final generalized Cauchy point

Projg = norm of the final projected gradient

F = final function value

* * *

N Tit Tnf Tnint Skip Nact Projg F

2 0 1 0 0 0 3.689D-06 1.918D+00

F = 1.9175996129577773

CONVERGENCE: NORM_OF_PROJECTED_GRADIENT_<=_PGTOL

RUNNING THE L-BFGS-B CODE

* * *

Machine precision = 2.220D-16

N = 3 M = 10

At X0 0 variables are exactly at the bounds

At iterate 0 f= 1.41373D+00 |proj g|= 9.51828D-04

* * *

Tit = total number of iterations

Tnf = total number of function evaluations

Tnint = total number of segments explored during Cauchy searches

Skip = number of BFGS updates skipped

Nact = number of active bounds at final generalized Cauchy point

Projg = norm of the final projected gradient

F = final function value

* * *

N Tit Tnf Tnint Skip Nact Projg F

3 2 5 1 0 0 4.516D-05 1.414D+00

F = 1.4137311050015484

CONVERGENCE: REL_REDUCTION_OF_F_<=_FACTR*EPSMCH

The table below contains the estimated parameter in the model, the estimated AR(1) coefficient, and the long-run mean which is either equal to the estimated parameters (AR(0) or ARIMA), or depends on the ratio of the intercept to 1 minus the AR(1) parameter.

[5]:

intercept = [

ar0_res.params[0],

sarimax_res.params[0],

arima_res.params[0],

autoreg_res.params[0],

]

rho_hat = [0] + [r.params[1] for r in (sarimax_res, arima_res, autoreg_res)]

long_run = [

ar0_res.params[0],

sarimax_res.params[0] / (1 - sarimax_res.params[1]),

arima_res.params[0],

autoreg_res.params[0] / (1 - autoreg_res.params[1]),

]

cols = ["AR(0)", "SARIMAX", "ARIMA", "AutoReg"]

pd.DataFrame(

[intercept, rho_hat, long_run],

columns=cols,

index=["delta-or-phi", "rho", "long-run mean"],

)

[5]:

| AR(0) | SARIMAX | ARIMA | AutoReg | |

|---|---|---|---|---|

| delta-or-phi | 9.7745 | 1.985714 | 9.774498 | 1.985790 |

| rho | 0.0000 | 0.796846 | 0.796875 | 0.796882 |

| long-run mean | 9.7745 | 9.774424 | 9.774498 | 9.776537 |

Differences between trend and exog in SARIMAX¶

When SARIMAX includes exog variables, then the exog are treated as OLS regressors, so that the model estimated is

In the next example, we omit the trend and instead include a column of 1, which produces a model that is equivalent, in large samples, to the case with no exogenous regressor and trend="c". Here the estimated value of const matches the value estimated using ARIMA. This happens since both exog in SARIMAX and the trend in ARIMA are treated as linear regression models with ARMA errors.

[6]:

sarimax_exog_res = SARIMAX(y, exog=np.ones_like(y), order=(1, 0, 0), trend="n").fit()

print(sarimax_exog_res.summary())

RUNNING THE L-BFGS-B CODE

* * *

Machine precision = 2.220D-16

N = 3 M = 10

At X0 0 variables are exactly at the bounds

At iterate 0 f= 1.41373D+00 |proj g|= 1.06920D-04

This problem is unconstrained.

* * *

Tit = total number of iterations

Tnf = total number of function evaluations

Tnint = total number of segments explored during Cauchy searches

Skip = number of BFGS updates skipped

Nact = number of active bounds at final generalized Cauchy point

Projg = norm of the final projected gradient

F = final function value

* * *

N Tit Tnf Tnint Skip Nact Projg F

3 1 4 1 0 0 4.752D-05 1.414D+00

F = 1.4137311099487531

CONVERGENCE: REL_REDUCTION_OF_F_<=_FACTR*EPSMCH

SARIMAX Results

==============================================================================

Dep. Variable: y No. Observations: 5000

Model: SARIMAX(1, 0, 0) Log Likelihood -7068.656

Date: Wed, 02 Nov 2022 AIC 14143.311

Time: 17:05:13 BIC 14162.863

Sample: 0 HQIC 14150.164

- 5000

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 9.7745 0.069 141.177 0.000 9.639 9.910

ar.L1 0.7969 0.009 93.691 0.000 0.780 0.814

sigma2 0.9894 0.020 49.921 0.000 0.951 1.028

===================================================================================

Ljung-Box (L1) (Q): 0.42 Jarque-Bera (JB): 0.08

Prob(Q): 0.51 Prob(JB): 0.96

Heteroskedasticity (H): 0.97 Skew: -0.01

Prob(H) (two-sided): 0.47 Kurtosis: 2.99

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

Using exog in SARIMAX and ARIMA¶

While exog are treated the same in both models, the intercept continues to differ. Below we add an exogenous regressor to y and then fit the model using all three methods. The data generating process is now

[7]:

full_x = rng.standard_normal(eta.shape)

x = full_x[200:]

y += 3 * x

[8]:

sarimax_exog_res = SARIMAX(y, exog=x, order=(1, 0, 0), trend="c").fit()

arima_exog_res = ARIMA(y, exog=x, order=(1, 0, 0), trend="c").fit()

RUNNING THE L-BFGS-B CODE

* * *

Machine precision = 2.220D-16

N = 4 M = 10

At X0 0 variables are exactly at the bounds

At iterate 0 f= 1.42683D+00 |proj g|= 2.05943D-01

This problem is unconstrained.

At iterate 5 f= 1.41332D+00 |proj g|= 1.60874D-03

At iterate 10 f= 1.41329D+00 |proj g|= 3.11658D-05

* * *

Tit = total number of iterations

Tnf = total number of function evaluations

Tnint = total number of segments explored during Cauchy searches

Skip = number of BFGS updates skipped

Nact = number of active bounds at final generalized Cauchy point

Projg = norm of the final projected gradient

F = final function value

* * *

N Tit Tnf Tnint Skip Nact Projg F

4 11 15 1 0 0 1.796D-06 1.413D+00

F = 1.4132928400115972

CONVERGENCE: NORM_OF_PROJECTED_GRADIENT_<=_PGTOL

Examining the parameter tables, we see that the parameter estimates on x1 are identical while the estimates of the intercept continue to differ due to the differences in the treatment of trends in these estimators.

SARIMAX¶

[9]:

def print_params(s):

from io import StringIO

return pd.read_csv(StringIO(s.tables[1].as_csv()), index_col=0)

print_params(sarimax_exog_res.summary())

[9]:

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| intercept | 1.9849 | 0.085 | 23.484 | 0.0 | 1.819 | 2.151 |

| x1 | 3.0231 | 0.011 | 277.150 | 0.0 | 3.002 | 3.044 |

| ar.L1 | 0.7969 | 0.009 | 93.735 | 0.0 | 0.780 | 0.814 |

| sigma2 | 0.9886 | 0.020 | 49.941 | 0.0 | 0.950 | 1.027 |

ARIMA¶

[10]:

print_params(arima_exog_res.summary())

[10]:

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 9.7741 | 0.069 | 141.201 | 0.0 | 9.638 | 9.910 |

| x1 | 3.0231 | 0.011 | 277.140 | 0.0 | 3.002 | 3.044 |

| ar.L1 | 0.7969 | 0.009 | 93.728 | 0.0 | 0.780 | 0.814 |

| sigma2 | 0.9886 | 0.020 | 49.941 | 0.0 | 0.950 | 1.027 |

exog in AutoReg¶

When using AutoReg to estimate a model using OLS, the model differs from both SARIMAX and ARIMA. The AutoReg specification with exogenous variables is

This specification is not equivalent to the specification estimated in SARIMAX and ARIMA. Here the difference is non-trivial, and naive estimation on the same time series results in different parameter values, even in large samples (and the limit). Estimating this model changes the parameter estimates on the AR(1) coefficient.

AutoReg¶

[11]:

autoreg_exog_res = AutoReg(y, 1, exog=x, trend="c").fit()

print_params(autoreg_exog_res.summary())

[11]:

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 7.9714 | 0.064 | 124.525 | 0.0 | 7.846 | 8.097 |

| y.L1 | 0.1838 | 0.006 | 29.890 | 0.0 | 0.172 | 0.196 |

| x1 | 3.0311 | 0.021 | 142.513 | 0.0 | 2.989 | 3.073 |

The key difference can be seen by writing the model in lag operator notation.

where it is is assumed that SARIMAX and ARIMA, which can be seen to be

In this specification,

Using the correct DGP with AutoReg¶

Simulating the process that is estimated in AutoReg shows that the parameters are recovered from the true model.

[12]:

y = beta + eta

epsilon = eta.copy()

for i in range(1, eta.shape[0]):

y[i] = beta * (1 - rho) + rho * y[i - 1] + 3 * full_x[i] + eta[i]

y = y[200:]

AutoReg with correct DGP¶

[13]:

autoreg_alt_exog_res = AutoReg(y, 1, exog=x, trend="c").fit()

print_params(autoreg_alt_exog_res.summary())

[13]:

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 1.9870 | 0.030 | 66.526 | 0.0 | 1.928 | 2.046 |

| y.L1 | 0.7968 | 0.003 | 300.382 | 0.0 | 0.792 | 0.802 |

| x1 | 3.0263 | 0.014 | 217.034 | 0.0 | 2.999 | 3.054 |

Reconstructing residuals, fitted values and forecasts in SARIMAX and ARIMA¶

In models that contain only autoregressive terms, trends and exogenous variables, fitted values and forecasts can be easily reconstructed once the maximum lag length in the model has been reached. In practice, this means after ARIMA, the prediction is

since ARIMA treats both exogenous and trend terms as regression with ARMA errors.

This can be seen in the next set of cells.

[14]:

arima_res = ARIMA(y, order=(1, 0, 0), trend="c").fit()

print_params(arima_res.summary())

[14]:

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 9.9346 | 0.222 | 44.667 | 0.0 | 9.499 | 10.371 |

| ar.L1 | 0.7957 | 0.009 | 92.515 | 0.0 | 0.779 | 0.813 |

| sigma2 | 10.3015 | 0.204 | 50.496 | 0.0 | 9.902 | 10.701 |

[15]:

arima_res.predict(0, 2)

[15]:

array([ 9.93458658, 10.91088035, 11.80415747])

[16]:

delta_hat, rho_hat = arima_res.params[:2]

delta_hat + rho_hat * (y[0] - delta_hat)

[16]:

10.910880346330751

SARIMAX treats trend terms differently, and so the one-step forecast from a model estimated using SARIMAX is

[17]:

sarima_res = SARIMAX(y, order=(1, 0, 0), trend="c").fit()

print_params(sarima_res.summary())

This problem is unconstrained.

RUNNING THE L-BFGS-B CODE

* * *

Machine precision = 2.220D-16

N = 3 M = 10

At X0 0 variables are exactly at the bounds

At iterate 0 f= 2.58518D+00 |proj g|= 5.99456D-05

* * *

Tit = total number of iterations

Tnf = total number of function evaluations

Tnint = total number of segments explored during Cauchy searches

Skip = number of BFGS updates skipped

Nact = number of active bounds at final generalized Cauchy point

Projg = norm of the final projected gradient

F = final function value

* * *

N Tit Tnf Tnint Skip Nact Projg F

3 3 5 1 0 0 3.347D-05 2.585D+00

F = 2.5851830060985752

CONVERGENCE: REL_REDUCTION_OF_F_<=_FACTR*EPSMCH

[17]:

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| intercept | 2.0283 | 0.097 | 20.841 | 0.0 | 1.838 | 2.219 |

| ar.L1 | 0.7959 | 0.009 | 92.536 | 0.0 | 0.779 | 0.813 |

| sigma2 | 10.3007 | 0.204 | 50.500 | 0.0 | 9.901 | 10.700 |

[18]:

sarima_res.predict(0, 2)

[18]:

array([ 9.93588659, 10.91128867, 11.80469658])

[19]:

delta_hat, rho_hat = sarima_res.params[:2]

delta_hat + rho_hat * y[0]

[19]:

10.911288670367867

Prediction with MA components¶

When a model contains a MA component, the prediction is more complicated since errors are never directly observable. The prediction is still

In the next cell we simulate an MA(1) process, and fit an MA model.

[20]:

rho = 0.8

beta = 10

epsilon = eta.copy()

for i in range(1, eta.shape[0]):

epsilon[i] = rho * eta[i - 1] + eta[i]

y = beta + epsilon

y = y[200:]

ma_res = ARIMA(y, order=(0, 0, 1), trend="c").fit()

print_params(ma_res.summary())

[20]:

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 9.9185 | 0.025 | 391.129 | 0.0 | 9.869 | 9.968 |

| ma.L1 | 0.8025 | 0.009 | 93.864 | 0.0 | 0.786 | 0.819 |

| sigma2 | 0.9904 | 0.020 | 49.925 | 0.0 | 0.951 | 1.029 |

We start by looking at predictions near the beginning of the sample corresponding y[1], …, y[5].

[21]:

ma_res.predict(1, 5)

[21]:

array([ 8.57011015, 9.19907188, 8.96971353, 9.78987115, 11.11984478])

and the corresponding residuals that are needed to produce the “direct” forecasts

[22]:

ma_res.resid[:5]

[22]:

array([-2.7621904 , -1.12255005, -1.33557621, -0.17206944, 1.5634041 ])

Using the model parameters, we can produce the “direct” forecasts using the MA(1) specification

We see that these are not especially close to the actual model predictions for the initial forecasts, but that the gap quickly reduces.

[23]:

delta_hat, rho_hat = ma_res.params[:2]

direct = delta_hat + rho_hat * ma_res.resid[:5]

direct

[23]:

array([ 7.70168405, 9.01756049, 8.84659855, 9.7803589 , 11.17314527])

The difference is nearly a standard deviation for the first but declines as the index increases.

[24]:

ma_res.predict(1, 5) - direct

[24]:

array([ 0.8684261 , 0.18151139, 0.12311499, 0.00951225, -0.05330049])

We next look at the end of the sample and the final three predictions.

[25]:

t = y.shape[0]

ma_res.predict(t - 3, t - 1)

[25]:

array([ 9.79692804, 10.51272714, 10.55855562])

[26]:

ma_res.resid[-4:-1]

[26]:

array([-0.15142355, 0.74049384, 0.79759816])

[27]:

direct = delta_hat + rho_hat * ma_res.resid[-4:-1]

direct

[27]:

array([ 9.79692804, 10.51272714, 10.55855562])

The “direct” forecasts are identical. This happens since the effect of the short sample has disappeared by the end of the sample (In practice it is negligible by observations 100 or so, and numerically absent by around observation 160).

[28]:

ma_res.predict(t - 3, t - 1) - direct

[28]:

array([0., 0., 0.])

The same principle applies in more complicated model that include multiple lags or seasonal term - predictions in AR models are simple once the effective lag length has been reached, while predictions in models that contains MA components are only simple once the maximum root of the MA lag polynomial is sufficiently small so that the residuals are close to the true residuals.

Prediction differences in SARIMAX and ARIMA¶

The formulas used to make predictions from SARIMAX and ARIMA models differ in one key aspect - ARIMA treats all trend terms, e.g, the intercept or time trend, as part of the exogenous regressors. For example, an AR(1) model with an intercept and linear time trend estimated using ARIMA has the specification

When the same model is estimated using SARIMAX, the specification is

The differences are more apparent when the model contains exogenous regressors, ARIMA specification is

while the SARIMAX specification is

The key difference between these two is that the intercept and the trend are effectively equivalent to exogenous regressions in ARIMA while they are more like standard ARMA terms in SARIMAX.

The next cell simulates an ARX with a time trend using the specification in ARIMA and estimates the parameters using both estimators.

[29]:

rho = 0.8

beta = 2

delta0 = 10

delta1 = 0.5

epsilon = eta.copy()

for i in range(1, eta.shape[0]):

epsilon[i] = rho * epsilon[i - 1] + eta[i]

t = np.arange(epsilon.shape[0])

y = delta0 + delta1 * t + beta * full_x + epsilon

y = y[200:]

[30]:

start = np.array([110, delta1, beta, rho, 1])

arx_res = ARIMA(y, exog=x, order=(1, 0, 0), trend="ct").fit()

mod = SARIMAX(y, exog=x, order=(1, 0, 0), trend="ct")

start[:2] *= 1 - rho

sarimax_res = mod.fit(start_params=start, method="bfgs")

Optimization terminated successfully.

Current function value: 1.413691

Iterations: 46

Function evaluations: 58

Gradient evaluations: 58

The two estimators fit similarly, although there is a small difference in the log-likelihood. This is a numerical issue and should not materially affect the predictions. Importantly the two trend parameters, const and x1 (unfortunately named for the time trend), differ between the two. The other parameters are effectively identical.

[31]:

print(arx_res.summary())

SARIMAX Results

==============================================================================

Dep. Variable: y No. Observations: 5000

Model: ARIMA(1, 0, 0) Log Likelihood -7069.171

Date: Wed, 02 Nov 2022 AIC 14148.343

Time: 17:05:25 BIC 14180.928

Sample: 0 HQIC 14159.763

- 5000

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 109.2112 0.137 796.186 0.000 108.942 109.480

x1 0.5000 4.78e-05 1.05e+04 0.000 0.500 0.500

x2 2.0495 0.011 187.517 0.000 2.028 2.071

ar.L1 0.7965 0.009 93.669 0.000 0.780 0.813

sigma2 0.9897 0.020 49.854 0.000 0.951 1.029

===================================================================================

Ljung-Box (L1) (Q): 0.33 Jarque-Bera (JB): 0.15

Prob(Q): 0.57 Prob(JB): 0.93

Heteroskedasticity (H): 0.97 Skew: -0.01

Prob(H) (two-sided): 0.53 Kurtosis: 3.00

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

[32]:

print(sarimax_res.summary())

SARIMAX Results

==============================================================================

Dep. Variable: y No. Observations: 5000

Model: SARIMAX(1, 0, 0) Log Likelihood -7068.457

Date: Wed, 02 Nov 2022 AIC 14146.914

Time: 17:05:25 BIC 14179.500

Sample: 0 HQIC 14158.335

- 5000

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

intercept 22.7438 0.929 24.481 0.000 20.923 24.565

drift 0.1019 0.004 23.985 0.000 0.094 0.110

x1 2.0230 0.011 185.290 0.000 2.002 2.044

ar.L1 0.7963 0.008 93.745 0.000 0.780 0.813

sigma2 0.9894 0.020 49.899 0.000 0.951 1.028

===================================================================================

Ljung-Box (L1) (Q): 0.47 Jarque-Bera (JB): 0.13

Prob(Q): 0.49 Prob(JB): 0.94

Heteroskedasticity (H): 0.97 Skew: -0.01

Prob(H) (two-sided): 0.47 Kurtosis: 3.00

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

Initial residuals SARIMAX and ARIMA¶

Residuals for observations before the maximal model order, which depends on the AR, MA, Seasonal AR, Seasonal MA and differencing parameters, are not reliable and should not be used for performance assessment. In general, in an ARIMA with orders

We can simulate some data from an ARIMA(1,0,0)(1,0,0,12) and examine the residuals.

[33]:

import numpy as np

import pandas as pd

rho = 0.8

psi = -0.6

beta = 20

epsilon = eta.copy()

for i in range(13, eta.shape[0]):

epsilon[i] = (

rho * epsilon[i - 1]

+ psi * epsilon[i - 12]

- (rho * psi) * epsilon[i - 13]

+ eta[i]

)

y = beta + epsilon

y = y[200:]

With a large sample, the parameter estimates are very close to the DGP parameters.

[34]:

res = ARIMA(y, order=(1, 0, 0), trend="c", seasonal_order=(1, 0, 0, 12)).fit()

print(res.summary())

SARIMAX Results

========================================================================================

Dep. Variable: y No. Observations: 5000

Model: ARIMA(1, 0, 0)x(1, 0, 0, 12) Log Likelihood -7076.266

Date: Wed, 02 Nov 2022 AIC 14160.532

Time: 17:05:28 BIC 14186.600

Sample: 0 HQIC 14169.668

- 5000

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 19.8586 0.043 458.609 0.000 19.774 19.943

ar.L1 0.7972 0.008 93.925 0.000 0.781 0.814

ar.S.L12 -0.6044 0.011 -53.280 0.000 -0.627 -0.582

sigma2 0.9914 0.020 49.899 0.000 0.952 1.030

===================================================================================

Ljung-Box (L1) (Q): 0.50 Jarque-Bera (JB): 0.11

Prob(Q): 0.48 Prob(JB): 0.95

Heteroskedasticity (H): 0.96 Skew: -0.01

Prob(H) (two-sided): 0.40 Kurtosis: 2.99

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

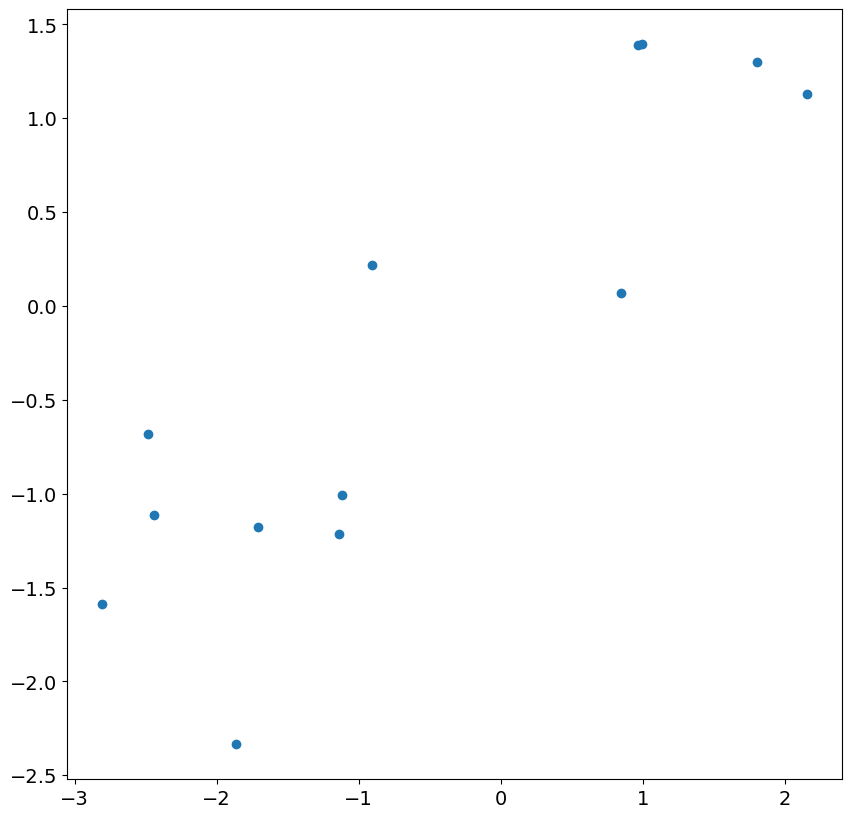

We can first examine the initial 13 residuals by plotting against the actual shocks in the model. While there is a correspondence, it is fairly weak and the correlation is much less than 1.

[35]:

import matplotlib.pyplot as plt

plt.rc("figure", figsize=(10, 10))

plt.rc("font", size=14)

_ = plt.scatter(res.resid[:13], eta[200 : 200 + 13])

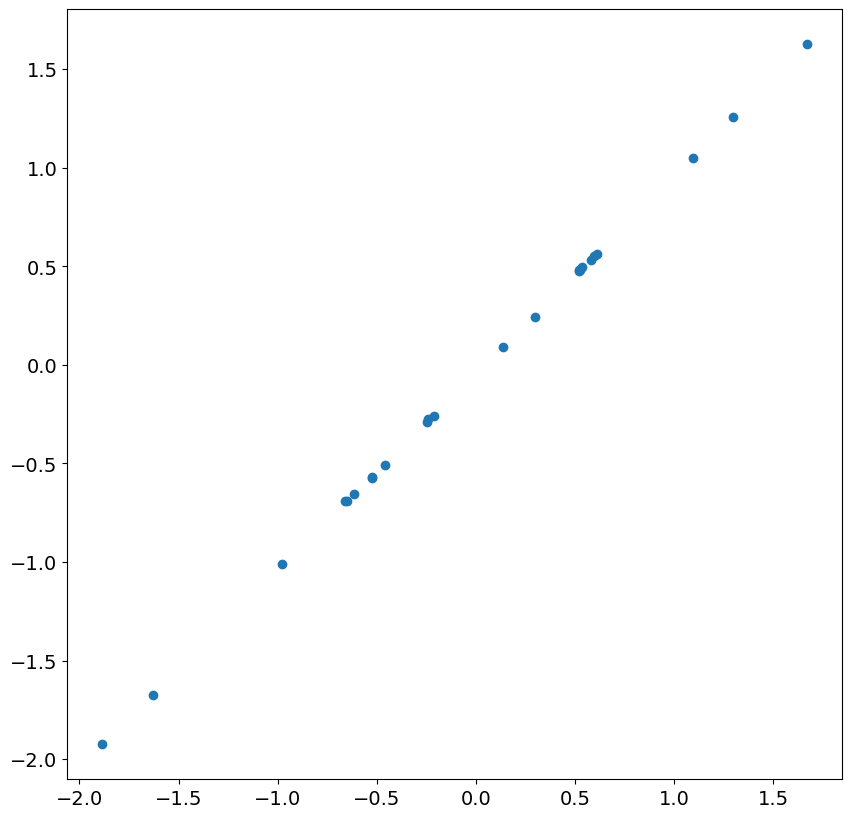

Looking at the next 24 residuals and shocks, we see there is nearly perfect correlation. This is expected in large samples once the less accurate residuals are ignored.

[36]:

_ = plt.scatter(res.resid[13:37], eta[200 + 13 : 200 + 37])

Next, we simulate an ARIMA(1,1,0), and include a time trend.

[37]:

rng = np.random.default_rng(20210819)

eta = rng.standard_normal(5200)

rho = 0.8

beta = 20

epsilon = eta.copy()

for i in range(2, eta.shape[0]):

epsilon[i] = (1 + rho) * epsilon[i - 1] - rho * epsilon[i - 2] + eta[i]

t = np.arange(epsilon.shape[0])

y = beta + 2 * t + epsilon

y = y[200:]

Again the parameter estimates are very close to the DGP parameters.

[38]:

res = ARIMA(y, order=(1, 1, 0), trend="t").fit()

print(res.summary())

SARIMAX Results

==============================================================================

Dep. Variable: y No. Observations: 5000

Model: ARIMA(1, 1, 0) Log Likelihood -7067.739

Date: Wed, 02 Nov 2022 AIC 14141.479

Time: 17:05:29 BIC 14161.030

Sample: 0 HQIC 14148.331

- 5000

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

x1 1.7747 0.069 25.642 0.000 1.639 1.910

ar.L1 0.7968 0.009 93.658 0.000 0.780 0.813

sigma2 0.9896 0.020 49.908 0.000 0.951 1.028

===================================================================================

Ljung-Box (L1) (Q): 0.43 Jarque-Bera (JB): 0.09

Prob(Q): 0.51 Prob(JB): 0.96

Heteroskedasticity (H): 0.97 Skew: -0.01

Prob(H) (two-sided): 0.47 Kurtosis: 2.99

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

The residuals are not accurate, and the first residual is approximately 500. The others are closer, although in this model the first 2 should usually be ignored.

[39]:

res.resid[:5]

[39]:

array([ 5.08403002e+02, -1.58904197e+00, -1.54902445e+00, 1.04992619e-01,

1.33644383e+00])

The reason why the first residual is so large is that the optimal prediction of this value is the mean of the difference, which is 1.77. Once the first value is known, the second value makes use of the first value in its prediction and the prediction is substantially closer to the truth.

[40]:

res.predict(0, 5)

[40]:

array([ 1.77472563, 511.95355129, 510.87392196, 508.85708934,

509.03356182, 511.85245439])

It is worth noting that the results class contains two parameters than can be helpful in understanding which residuals are problematic, loglikelihood_burn and nobs_diffuse.

[41]:

res.loglikelihood_burn, res.nobs_diffuse

[41]:

(1, 0)